Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

No episode of Builders this week, the podcast will take a very well earned pause in August and come back in September for Season 3. In the meanwhile you can always recover the first 2 Seasons here on YouTube, or here on Spotify.

Let me know who would you like to see as a guest and get in touch with me if you think you could be a good fit!

Also, I will be speaking at Money 20/20 Middle East, 15-17th September in Riyadh! I will moderate a panel about profitability vs growth in fintech investing, happy to catch up if you are joining the event!

Coming back to us, I was reading a very interesting report this week, the “Money Movement 2.0” by FiftyOne and Fintech Blueprint. The report is a very interesting study on how stablecoins are reshaping global finance and commerce, taking in consideration both volumes over time and recent news in the market. Here my main takeaways:

In the last five years, stablecoin total supply has jumped from under $10B to more than $248B, signaling one of the fastest infrastructure shifts in modern finance. Since 2019, stablecoins have processed $253.2T in transaction volume, $21.5T in adjusted volume, and 15.6B transactions, supported by an average supply of $96.2B and 619.7M unique active addresses.

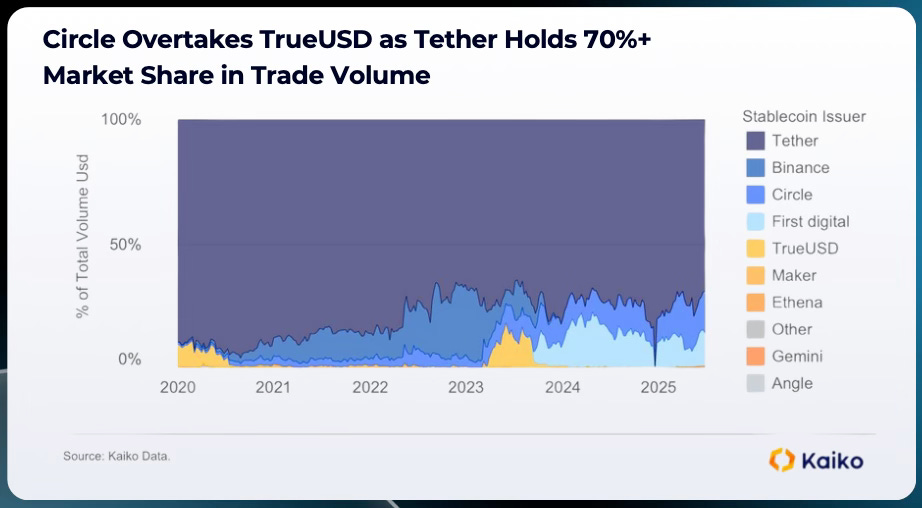

Adoption continues to accelerate, with 38.3M monthly active users in June 2025, a 13.25% increase month over month, driven largely by BNB Chain and Tron, which together host 54% of active wallets. USDT remains the market leader with a $156B capitalization, followed by USDC at $61.3B and USDe at $5.59B. Market dynamics are shifting, as USDT’s share has declined from 70% to 64% while USDC has risen to 25%. Projections suggest the sector could scale to $2T by 2028.

Enterprise adoption is accelerating as well, with institutions holding over 30% of total supply. Banks are leading cross-border use, being 2x more likely (58%) to prioritize it compared to other crypto applications. In payroll, USDT and USDC dominate, powering 65% of crypto-based salaries. Businesses value speed most, with 48% citing it as the primary benefit—1.5x higher than cost savings.

Among small and medium enterprises, 81% of those aware of crypto express interest in integrating stablecoins into operations. Geographically, usage has diversified: in 2022, 94% of transactions were in North America, but today the share has dropped to 41%, with Europe now at 33% and Asia at 21%, highlighting global expansion.

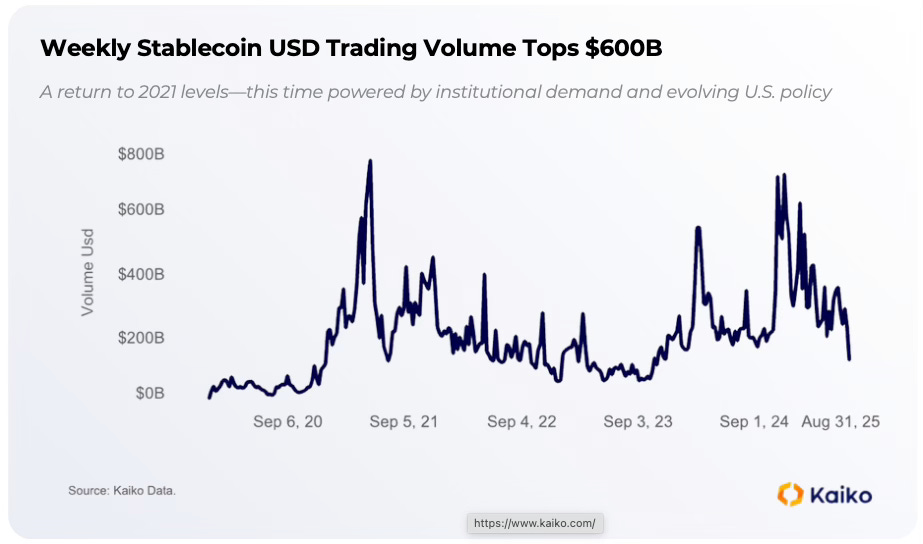

Stablecoins have overtaken fiat as the dominant trading pair on crypto exchanges, highlighting a structural shift in market infrastructure. Data from Kaiko shows that since January 2023, stablecoin trading volumes have consistently outpaced fiat, with spikes surpassing $800B during periods of heightened activity.

While fiat volumes have remained relatively steady, stablecoins now provide the majority of liquidity, reflecting their efficiency, speed, and accessibility for both retail and institutional participants. Stablecoins are no longer just an alternative to fiat but the preferred settlement layer across global crypto markets, further cementing their role in digital finance.

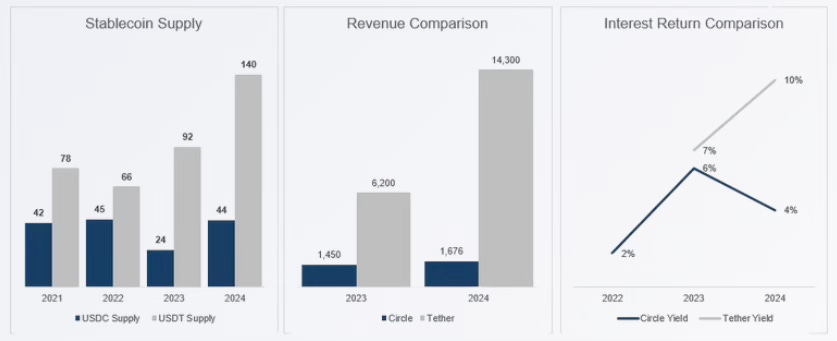

We can see this impact also in public markets. Circle ($CRCL) made a blockbuster public debut on June 5, pricing at $31 per share and soaring to $200, more than six times its IPO price. The rally pushed its valuation above $40B, signaling strong institutional appetite for crypto infrastructure at fintech-style premiums. Circle’s compliance-driven model has gained Wall Street’s trust, but challenges remain.

Margins are under pressure as distribution costs rise, with Coinbase taking a share, while rival Tether generates 8x more revenue through leaner operations and riskier strategies. The key test is whether Circle can justify its valuation before falling interest rates reduce yields, but one thing is clear: crypto infrastructure is now firmly investable.

Anyway we saw a lot of interesting news this week. OpenAI eyes a $500 billion valuation in a secondary sale, while Anthropic is looking to raise $10 billion at a staggering $170 billion valuation. Klarna just sold $26 billion of BNPL npl in the US, and at the same time got a $1.4 billion facility from Santander. Gemini prepares to go public, while Bullish completed their $1.15 billion IPO completely settled in stablecoins and Revolut just became Lithuania’s largest bank in just 5 years. In the VC market, we saw Norrsken Evolve to close a $57 million fund, Clean Growth Fund to launch a $56.8 million fund and Veteran Ventures Capital a $60 million fund. And finally, some very interesting funding rounds from fintech companies like Kunzapp, Block Earner, Midas, Casca, Plata Card, Cointel and many others.

But let's take a closer look at the main news of the last seven days.

Closed deals

Kunzapp secures $2 million Seed to redefine software spend management in LatAm

IVIX secures $60 million Series B to combat frauds in fintech using AI

Innerworks raises $4 million to build the immune system against AI Fraud in fintech

Mongolia’s AND Global Pte. Ltd., raises $21.4 million Series B to power fintech expansion in Southeast Asia

Block Earner raises $8 million Series A to push crypto-backed credit

Databricks hits $100+ billion valuation with Series K as AI demand accelerates

Firecrawl raises $14.5 million to redefine web data access for AI and developers

Midas raises $80 million in record-breaking round to transform retail investing in Turkey

Casca raises $29 million to redefine loan origination with AI

Artifact AI raises a $4 million Seed to launch “Arti,” its autonomous accounting agent

Cointel raises $7.4 million to scale AI-powered crypto education and trading intelligence

Priority secures $50 million financing facility and acquires Boom Commerce assets

Endless raises $110 million to bridge AI and Web3 at $1 billion valuation

Banco Plata targets $3.3 billion valuation as Mexico’s “Nubank for credit” rises

LO:TECH raises $5 million to rebuild capital markets on blockchain rails

Insights on the VC industry

Norrsken Evolve launches €57 million fund to back Europe’s sustainable future

Clean Growth Fund secures €56.8 million to accelerate UK climateTech innovation

Veteran Ventures Capital closes a $60 million Fund II to back dual-use defense innovations

News on the market

OpenAI eyes $500 billion valuation in landmark $6 billion secondary sale

Monzo Bank prepares Mobile Service Launch as Fintechs Eye Telecom Diversification

Nubank delivers 42% profit surge as shares jump on strong Q2 results

Gemini prepares for Nasdaq debut as the crypto exchange files for the IPO

Visa expands Click to Pay across Asia Pacific with leading payment partners

Klarna is selling $26 billion of US BNPL debt ahead of anticipated IPO

Starling Bank acquires Ember to redefine SMEs banking in the UK

Breaking news at N26: Co-founder Valentin Stalf steps down as CEO

Revolut is now Lithuania’s largest bank, after only five years

Robinhood brings AI-powered stock “Digests” tool to UK investors

Figure files for IPO as Mike Cagney returns to public markets

Circle acquires Malachite to power Arc, its new payments blockchain

Bullish completes $1.15 billion IPO, settled entirely in stablecoins

Ripple extends $75 million credit line to Gemini as IPO plans advance

Japan approves first yen-pegged stablecoin as JPYC株式会社 aims for ¥1 trillion issuance

Apollo Global Management, Inc. and Blackstone are leveraging football transfer fees as collateral for high-yield loans

Kraken acquires Capitalise.ai to bring No-Code trading to the masses

Openbank taps Upvest to power next-gen investment platform in Germany

MetaMask launches native stablecoin $mUSD in partnership with Stripe’s Bridge

Klarna secures €1.4 billion facility from Santander as BNPL push accelerates

A special look in the Italian market

-

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

Money 20/20 - Riyadh | 15-17.09.2025 (link to event)

Italian Tech Week - Turin | 1-3.10.2025 (link to event)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #94