Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

No episode of Builders this week, the podcast will take a very well earned pause in August and come back in September for Season 3. In the meanwhile you can always recover the first 2 Seasons here on YouTube, or here on Spotify.

Let me know who would you like to see as a guest and get in touch with me if you think you could be a good fit!

Coming back to us, I was reading a very interesting report this week, “Fintech next chapter: scaled winners and emerging disruptors” from Boston Consulting Group (BCG). This report is informed by conversations with more than 60 fintech executives and investors from across the globe and by, research, and primary analyses. It begins with an overview of the current state of fintech, looking at where fintechs have won so far, then share five forecasts of trends that will shape the next chapter. Here my main takeaways:

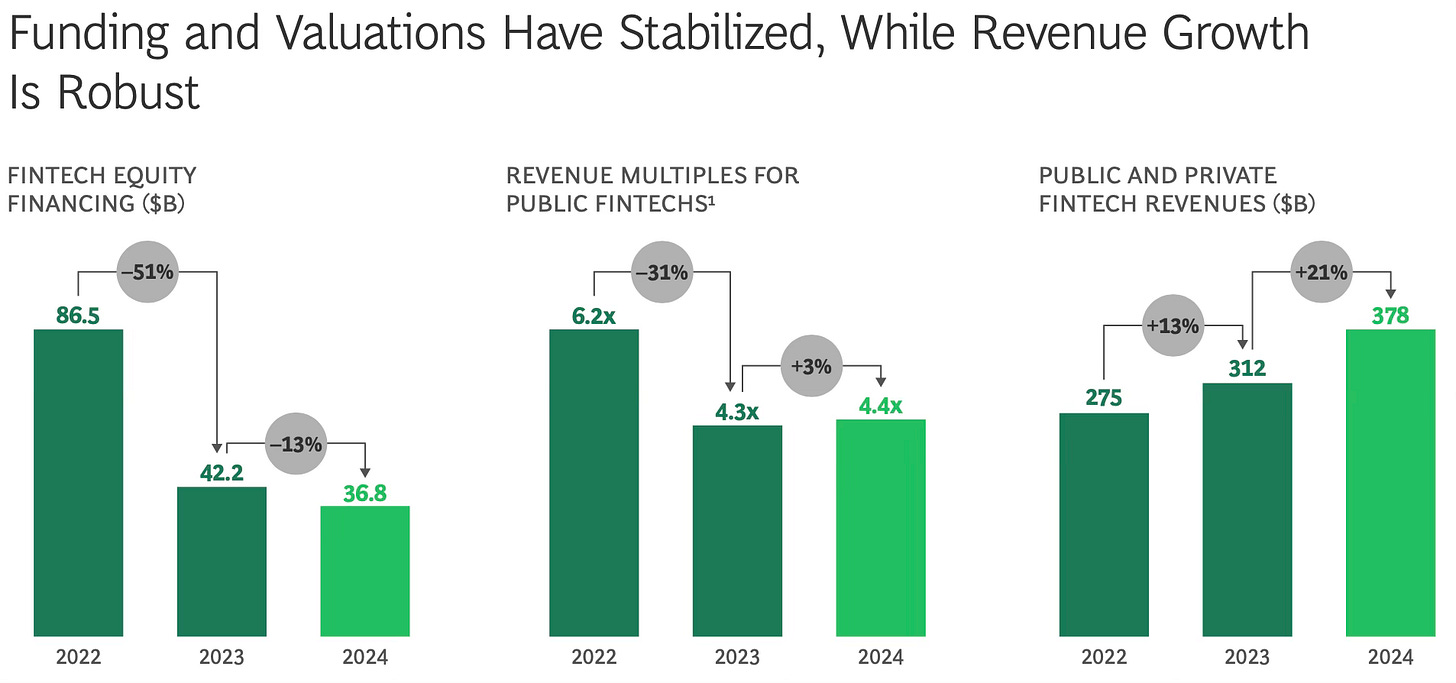

Equity funding for fintech declined 13% year-over-year in 2024, a softer drop compared to the steep 51% fall recorded in 2023. Valuations showed slight improvement, with revenue multiples rising 3% after a sharp 31% contraction the year before. Despite these signs of stabilization, the IPO market remained largely stagnant, with only 28 fintechs going public, up from 20 in 2023, but none raising more than $1 billion.

The sector also faced mounting regulatory pressures: Chime was fined $2.5 million for delayed customer fund returns, Block incurred an $86 million penalty over AML lapses, and Synapse collapsed in April, jeopardizing $96 million in client assets. Still, momentum shifted toward the end of 2024 and into 2025, as Q1 equity funding surged 34% year-over-year and revenue multiples advanced a further 10%, suggesting renewed investor confidence.

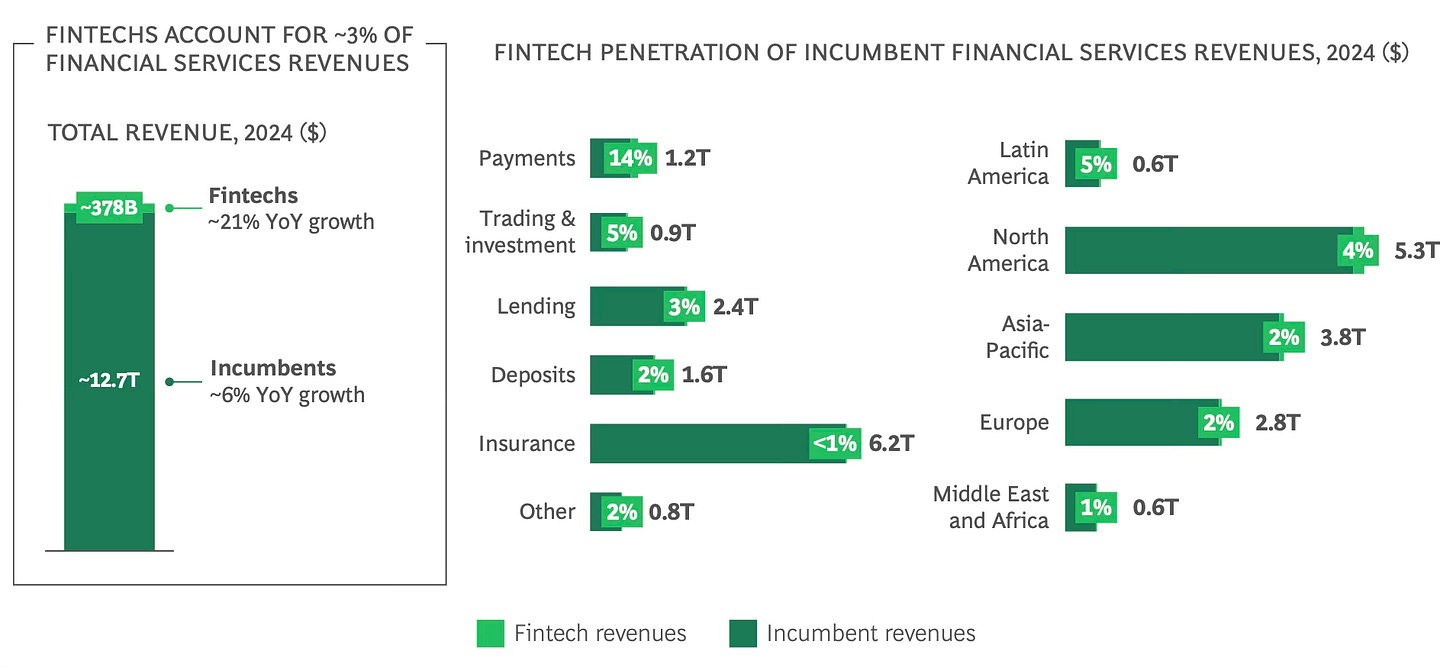

Fintech fundamentals strengthened markedly in 2024, with revenues climbing 21% year-over-year—well above the 13% growth seen in 2023 and more than triple the 6% rate for financial services overall. Deposits rose 23%, led by challenger banks such as Nubank, Revolut, and Monzo. Trading and investment platforms grew 21%, fueled by a rebound in crypto activity, particularly at Coinbase, and buoyed by stronger equity markets. Insurance was the standout vertical, expanding 40%, driven mainly by service providers and brokers.

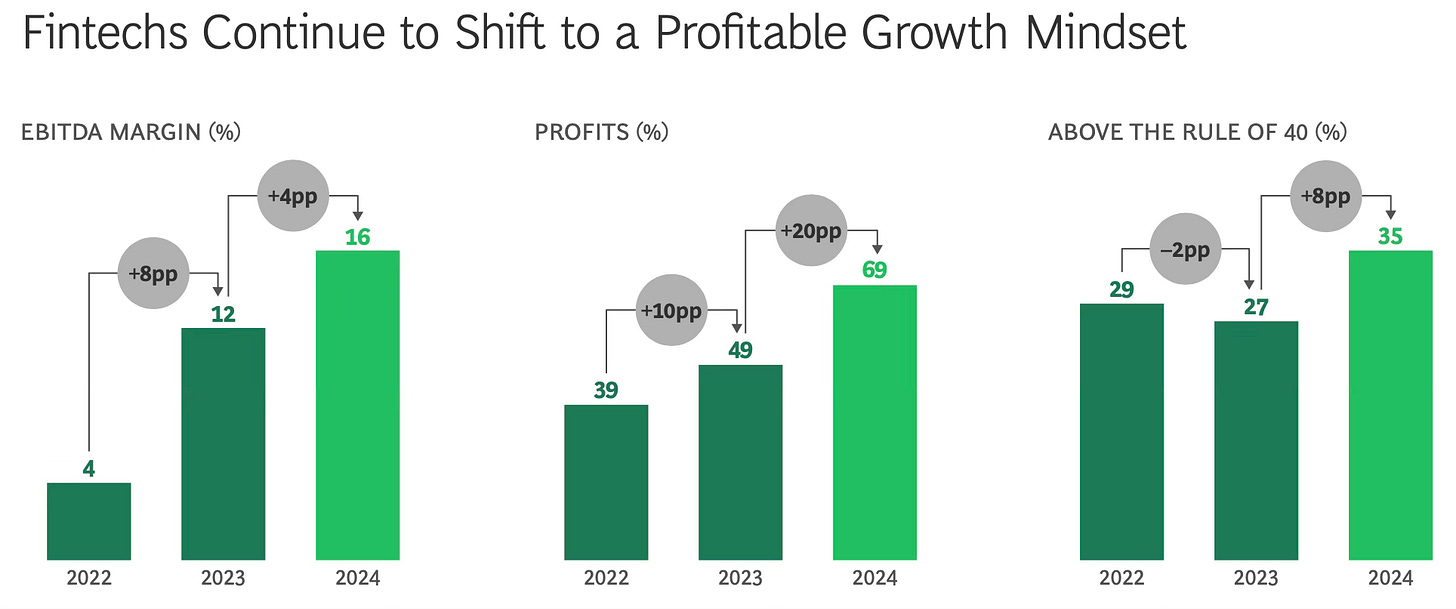

Profitability also improved as the sector shifted from “growth at all costs” to “profitable growth.” Average EBITDA margins rose four points to 16%, a 25% gain, with 69% of public fintechs now profitable versus less than half in 2023. Moreover, 35% surpassed the “rule of 40” benchmark, combining strong revenue growth and margins.

Despite these solid fundamentals, macroeconomic volatility has delayed several IPOs. Yet with 150 fintechs founded before 2016, each with over $500 million raised—including Stripe, Revolut, PhonePe, and Viva Republica (Toss)—the industry appears structurally poised for a new wave of listings once market conditions stabilize.

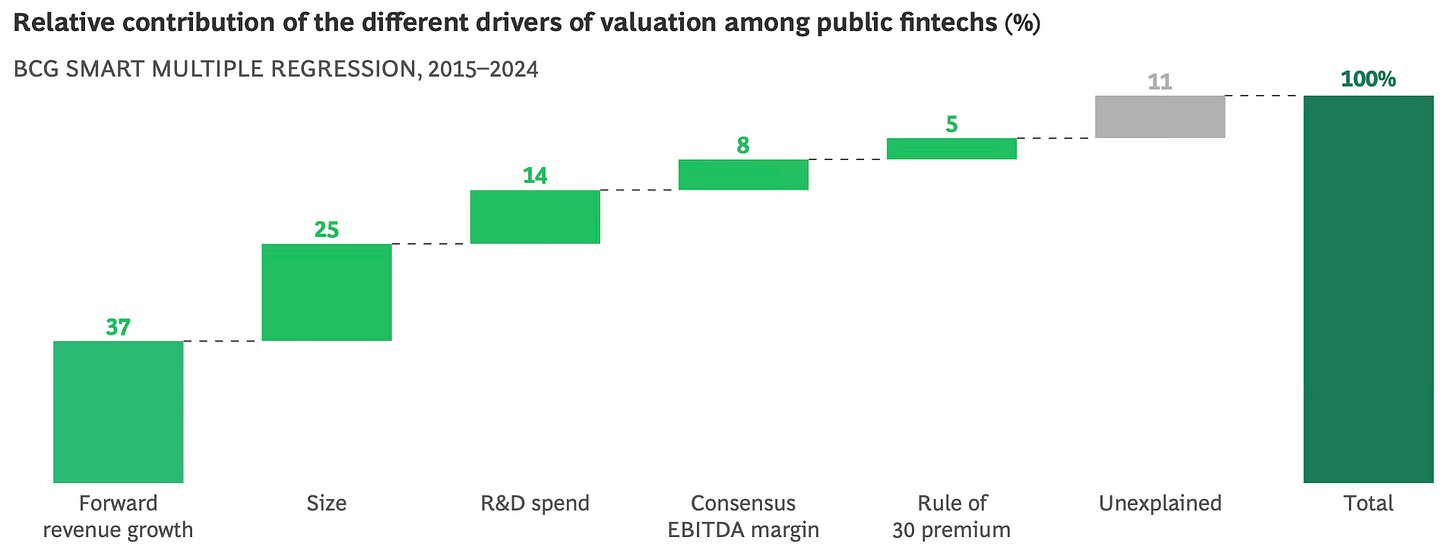

The next IPO cycle for fintechs is expected to look very different from the last, with investors placing greater emphasis on sustainable business models, regulatory readiness, and scalability. Analysis of public fintech valuations shows that half of the variation is explained by forward revenue growth and profitability, measured through EBITDA margins and the “rule of 30,” underscoring the sector’s shift toward fundamentals. Company size (25%) and R&D investment (14%) also play a key role, highlighting the importance of scale and innovation in attracting investor confidence.

At the same time, M&A activity is set to accelerate. Fintechs unable to demonstrate a clear path to profitability will likely become acquisition targets, particularly in today’s uncertain macro environment. Stronger players, benefiting from lower capital costs, may use consolidation and strategic acquisitions to enhance scale, broaden product lines, or expand internationally.

As IPOs gradually return and M&A gains momentum, the cycle could create a reinforcing loop of capital recycling into private markets. This would also benefit earlier-stage fintechs, as global venture capital dry powder of $677 billion—13% historically directed to fintechs—alongside $1.5 trillion in private equity dry powder, begins to flow back into the ecosystem.

Out of roughly 37,000 fintechs worldwide, fewer than 100 have reached meaningful scale. Despite this, fintechs still capture only about 3% of global banking and insurance revenues, leaving significant untapped opportunities across both verticals and geographies.

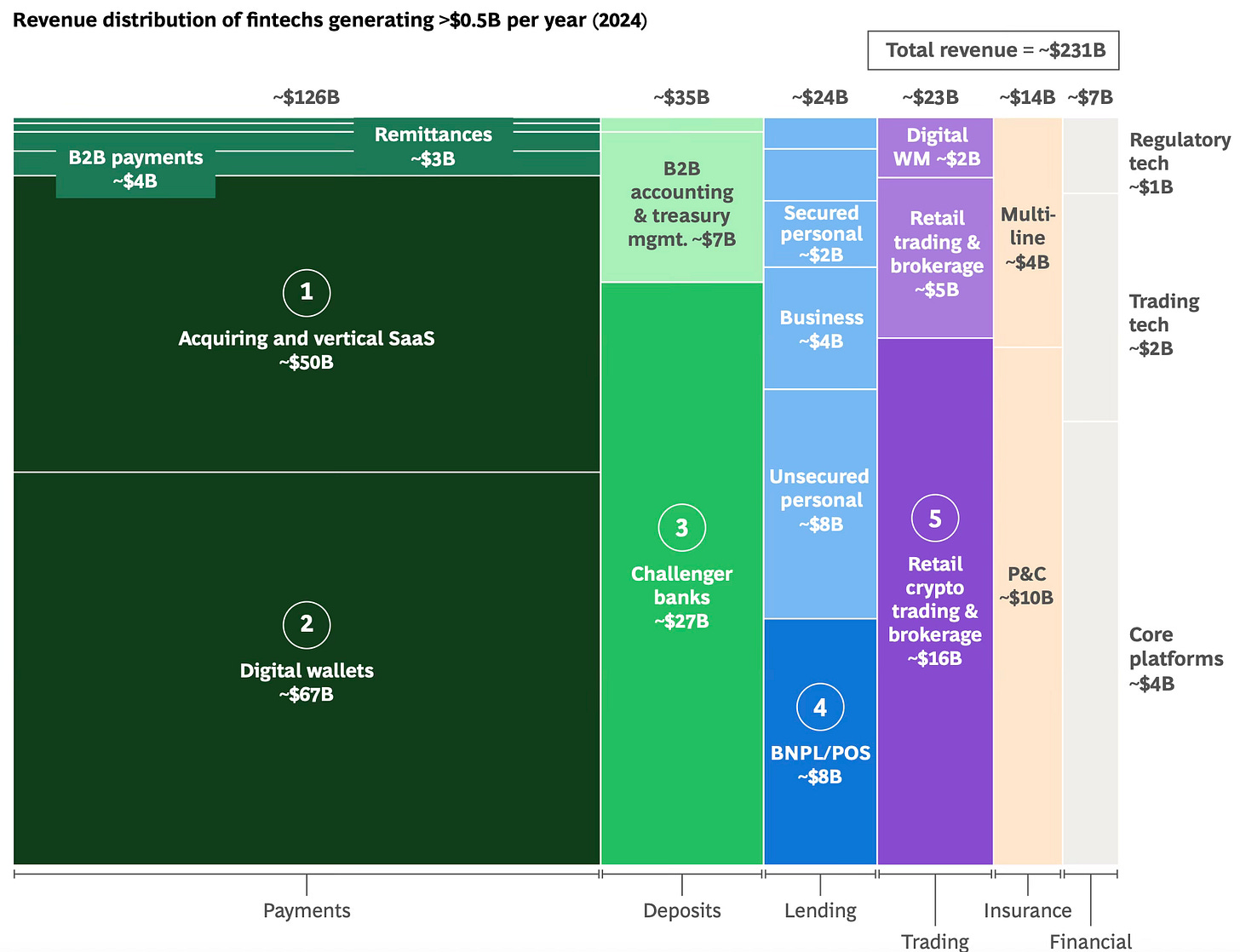

So far, success has been concentrated in a few core areas. Payments dominate the landscape, generating around 55% of scaled fintech revenues in 2024—about $126 billion—driven by digital wallets such as PayPal, Weixin/WeChat, and Apple Pay, as well as merchant acquirers and vertical SaaS platforms like Stripe, Adyen, Toast, Shopify, and Square. Challenger banks follow at 15% (about $27 billion), with leading players including Revolut, Monzo, KakaoBank, Nubank , and Toss. Retail crypto trading and brokerage firms such as Coinbase and Binance rank third with 7% (roughly $16 billion). Meanwhile, BNPL and point-of-sale lenders, though still only 4% (~$8 billion), stand out with rapid growth, expanding at a 42% CAGR and emerging as one of the most dynamic verticals in fintech’s evolution.

Geographic patterns of scaled fintech success highlight stark differences across markets. The United States leads by a wide margin, accounting for about 52% of scaled revenues—roughly $120 billion—driven by its vast addressable market and deep capital access. Payments dominate, supported by a card-centric, consumer-driven economy and e-commerce growth. Digital wallets and merchant acquirers thrive, while vertical SaaS players like Toast and Shopify have scaled by bundling payments into broader solutions for fragmented SMB markets.

China follows with 16% of scaled revenues, or around $38 billion, propelled by its massive domestic market and the rise of super apps such as WeChat and Alipay, built by tech giants Tencent and Alibaba.

Europe, by contrast, lags significantly at 8% (~$19 billion). Fragmented markets and complex regulation have made scaling harder, yet notable successes exist. Challenger banks like Revolut, Starling, and Monzo, remittance specialists like Wise, and BNPL providers such as Klarna have carved strong niches, particularly among younger consumers drawn to superior digital interfaces and low-cost cross-border services.

Anyway we saw a lot of interesting news this week. Stripe expands in Brazil providing Pix access through an integration with EBANX, while at the same time building the “Tempo” blockchain in partnership with Paradigm, Square acquired Tola, and Revolut is moving on with its plan to lend a license in Morocco. Perplexity made a bold move and offered $34.5 billion to acquire Google Chrome from Google, Bitpanda launched crypto services in the UK and Santander accelerated its AI-first strategy with a partnership with OpenAI. In the VC ecosystem, we saw Northpoint Capital closing a $150 million fund, Italian Founders Fund adding $35 million to their latest fund and Airtree ventures closing $650 million for two new funds. In the Italian market, Bending Spoons is closing a $500 million debt facility to fuel its acquisition strategy. And finally, some very interesting funding rounds from fintech startups like Riva Money, Casap, HoneyCoin, Mesh, Bumper UK, Transak and many others.

But let's take a closer look at the main news of the last seven days.

Closed deals

Casap secures $25 million Series A to combat payment disputes with AI

BOB raises €8.1 million to redefine Bitcoin’s role in DeFi with hybrid layer 2 chain

TurnStay secures $2. million to transform travel payments across Africa

Zodia Markets secures $18.25 million to accelerate institutional stablecoin trading

Riva Money secures $3 million to build blockchain-powered global payments network

Transak secures $16 million from Tether.io and IDG Capital to expand global stablecoin payments infrastructure

Appcharge raises $58 million to disrupt App Store payments and empower game developers

HoneyCoin raises $4.9 million to scale stablecoin-powered cross-border payments across Africa

Lorikeet raises $35 million to redefine AI customer service beyond chatbots

FincFriends raises $4.7 million in debt to expand digital lending in India’s smaller cities

plancraft secures €38 million Series B to bring AI-first tools to Europe’s construction sector

Smart Pension secures €69.4 million credit facility to accelerate global retirement tech expansion

Mesh secures new strategic funding from PayPal Ventures to scale global crypto payments

1Kosmos secures $57 million Series B to accelerate passwordless identity verification worldwide

Bumper UK raises $11 million to expand BNPL for car repairs across Europe

Insights on the VC industry

Northpoint Capital launches $150 million fund to back early-stage AI startups

Italian Founders Fund adds €35 million for its new fund with investment from CDP Venture Capital SGR

Airtree Ventures closes $650 million across Seed and Growth funds to back ANZ tech founders

News on the market

QuantumLight is one of the best application of AI to VC, wanna take a look at what they invested on?

Stripe expands in Brazil with Pix payments via EBANX partnership

Western Union to acquire Intermex - International Money Express in $500 million deal

Square acquires Tola team to strengthen SMB financial tools

Stripe is building ‘Tempo’ blockchain with Paradigm to power next-gen stablecoin payments

Revolut moves to enter Moroccan market, seeks approval from Bank Al-Maghrib

Zilch reports record FY25 growth, cementing status as UK’s fastest-growing fintech unicorn

Click Labs acquires UK’s Evermile to bring AI-powered retail operations to SMEs worldwide

BharatPe nears $80–100 million pre-IPO raise led by Coatue Management

Santander accelerates “AI-first” transformation with OpenAI partnership

Perplexity AI makes bold $34.5 billion bid for Google Chrome

Robinhood targets MENA growth with Dubai Financial Services Authority (DFSA) license application

Bitpanda brings 600+ cryptoassets to the UK in landmark launch

Adyen shares slide nearly 20% as revenue outlook cut on U.S. tariff impact

Ripple’s RLUSD stablecoin gains new reach through Mesh integration

A special look in the Italian market

Bending Spoons announces €500 million debt financing to fuel its acquisition roadmap

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

Italian Tech Week - Turin | 1-3.10.2025 (link to event)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #93