Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

No episode of Builders this week, but you can always recover the last one where I sit down with Elias Apel, CEO of Lucanet. You can find the full episode here on youtube, or here on Spotify or here on Apple Podcast.

Elias has multiple years of experience in the financial industry, with experiences in IEG - Investment Banking Group and ARGONAS. He joined Lucanet in 2018 as sales manager and then climbed the corporate ladder until becoming CEO in 2023.

Lucanet is one of the major CFOs solutions providers, trusted by more than 5,000 companies globally, with multiple locations around the world and more than 800 employees.

During this interview, recorded during Lucanet 2025 in Berlin, we’ve been talking about his experience going from sales to CEO, the opportunity and challenges in the fintech space, but also the importance of ESG in financial decisions and the impact of AI in his day-to-day operations.

This was also the last episode for season 2! The podcast will take a very well earned pause in August and come back in September for season 3. Let me know who would you like to see as a guest and get in touch with me if you think you could be a good fit!

Coming back to us, I was reading a very interesting report this week, “How AI could reshape the economics of the asset management industry” by McKinsey & Company. The study was conducted as a survey among Asset Managers all over the globe, with more than $250 billion in AuM, asking them how the advance of AI could potentially impact their job in the upcoming years. Here my main takeaways:

Over the past decade, the asset management industry benefited from strong market tailwinds, with low interest rates, steady GDP growth, and geopolitical stability driving positive performance and net inflows. This environment fueled unprecedented market gains and record levels of assets under management (AUM). However, since 2022, these favorable conditions have largely reversed. That year saw a sharp 10% drop in AUM, and while 2023 brought some recovery in markets and flows, costs have continued to rise, revenues have become volatile, and margins have come under pressure.

Between 2019 and 2023, pre-tax operating margins fell by three percentage points in North America and five in Europe, with North American managers facing an 18% cost increase against revenue growth of only 15%. Inflation, interest rate volatility, and geopolitical uncertainty have further heightened revenue unpredictability, making structural cost management a critical priority for restoring profitability and resilience.

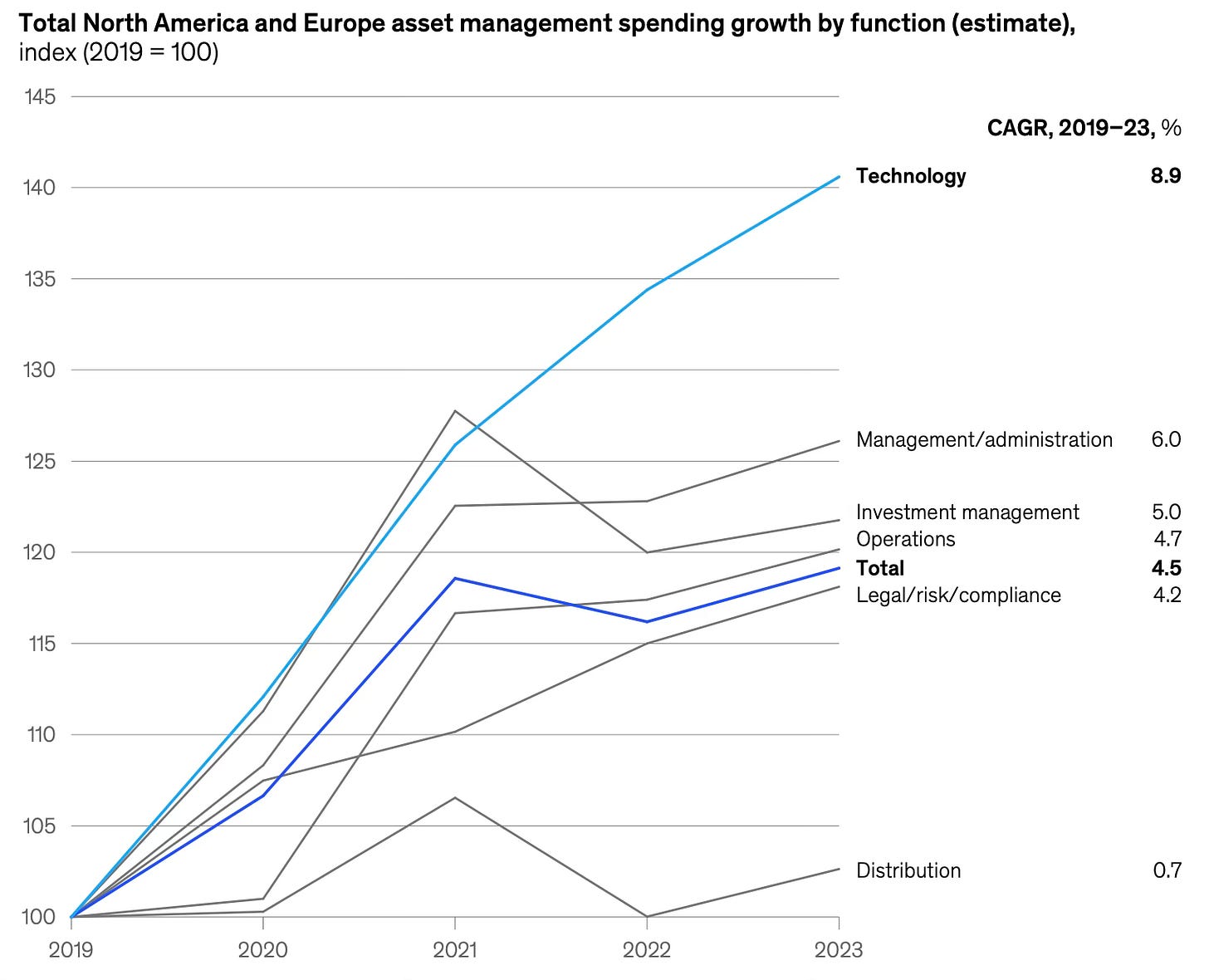

A significant contributor to rising costs has been technology spending, which has grown at an 8.9% annual rate in North America and Europe—far above other operational expenses. While technology remains central to strategic transformation and offers potential for productivity and growth, the industry faces a “productivity paradox,” with gains not yet fully reflected in performance metrics.

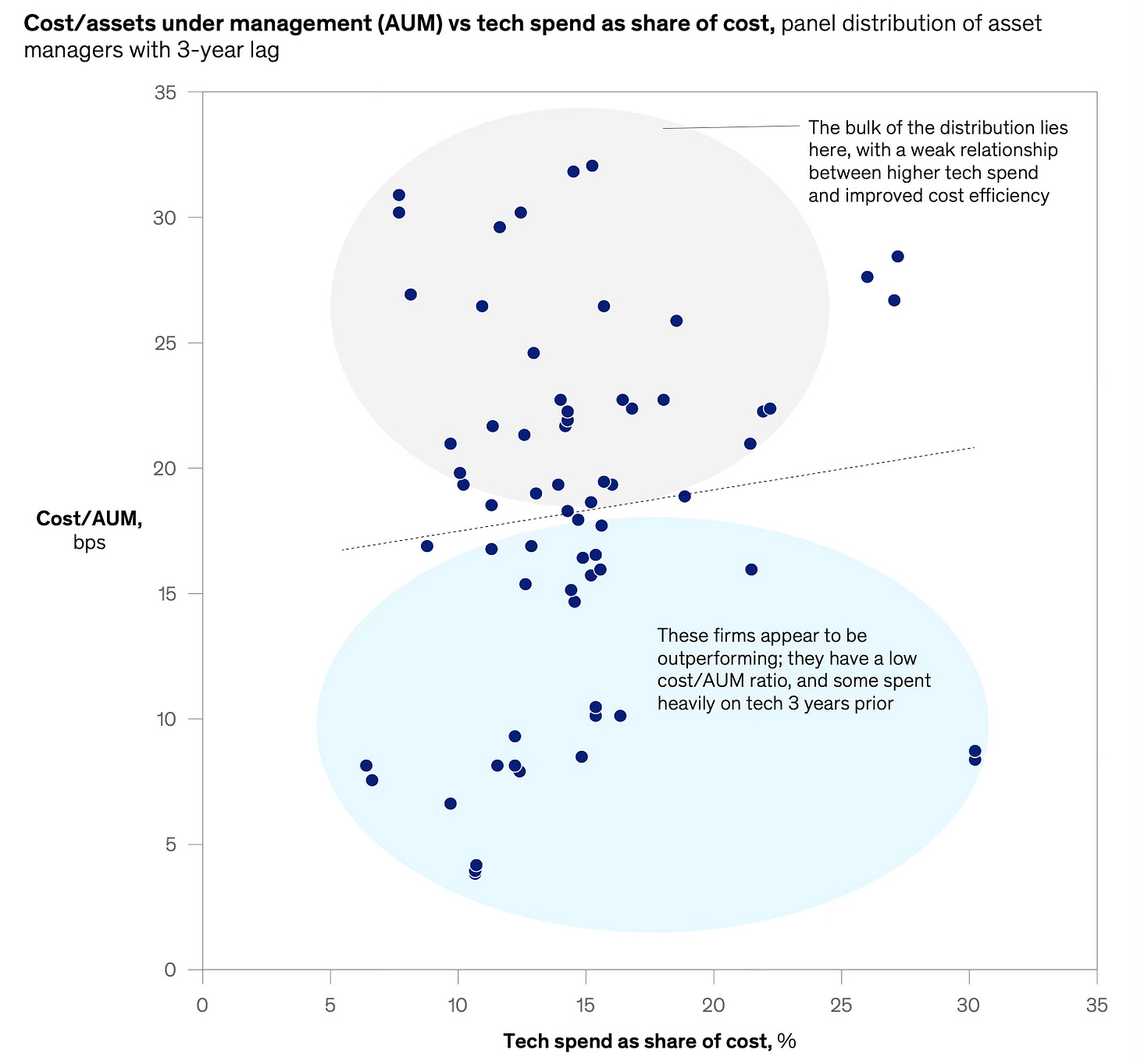

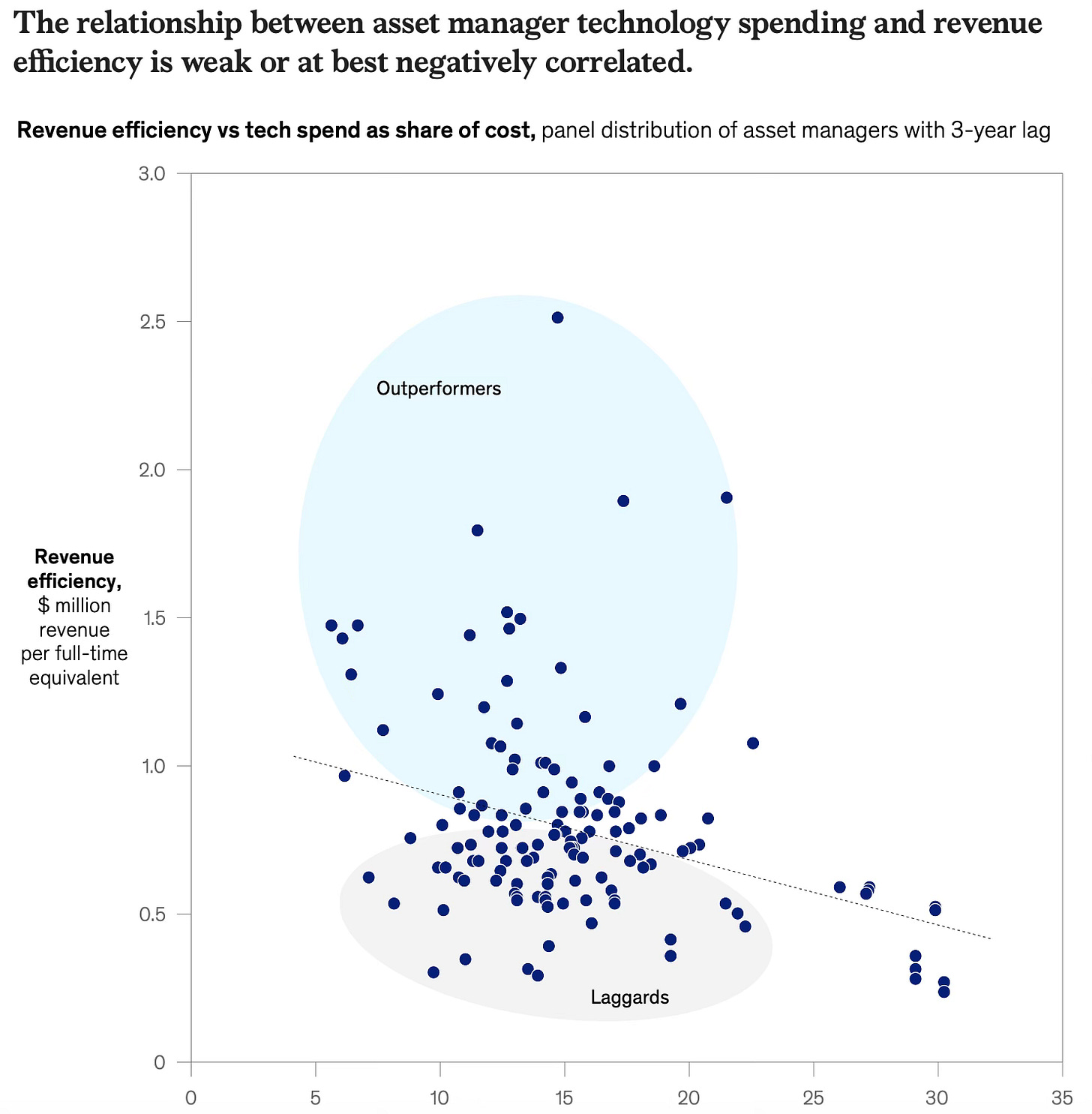

Despite steadily increasing technology investments, asset managers have struggled to translate spending into meaningful productivity gains. At an industry level, cost as a share of AUM has remained flat, and operational expenses in other functions have not declined as expected. Firm-level data shows no consistent correlation between higher tech spend and stronger performance on key metrics like cost-to-AUM or revenue per employee, with statistical analysis indicating an almost negligible relationship.

A key reason is the allocation of budgets: on average, 60–80% of technology spending goes to maintaining operations and legacy systems, leaving only 20–40% for initiatives aimed at transformation. Of that smaller share, just 5–10% of total tech spend is dedicated to firmwide digital transformation, with the rest supporting narrow use cases that fail to scale. This imbalance keeps firms locked in a cycle of high maintenance costs, growing technical debt, and missed opportunities for efficiency.

An illustrative case is a $1 trillion AUM firm that once spent 80% of its tech budget on run-the-business projects. Facing margin pressure and technology debt, it restructured its approach, shifting 70% of spending toward transformation. This was achieved through focusing on core strengths, migrating to cloud-based platforms, shortening product development cycles, and reducing reliance on contractors.

Some financial institutions, like Singapore’s DBS Bank, show that strategic technology adoption can drive above-market growth. In asset management, AI is beginning to deliver measurable gains in revenue, efficiency, and risk reduction through applications such as portfolio optimization, client targeting, and compliance automation.

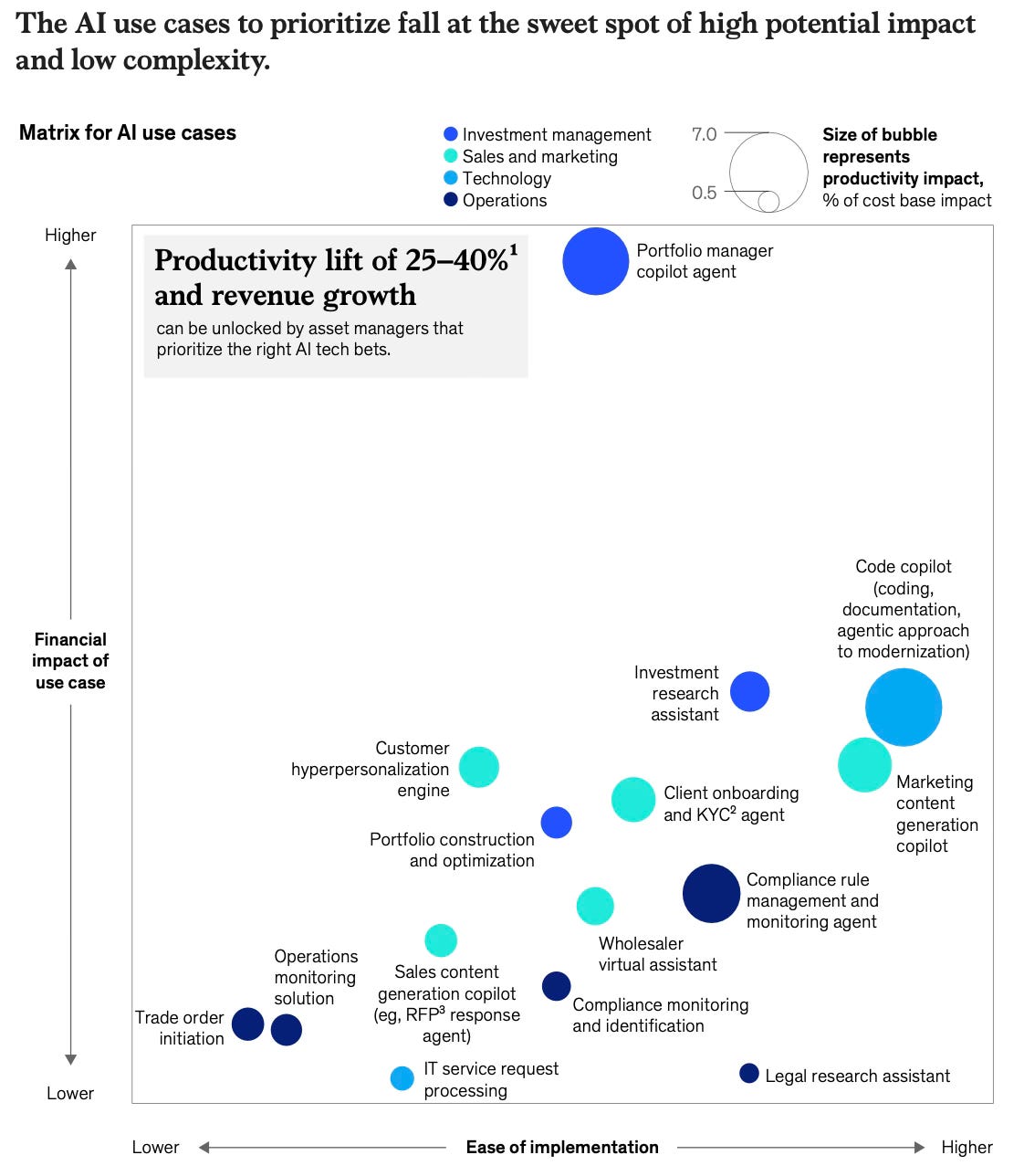

The rise of agentic AI offers a rare chance to cut costs by up to 40% through full workflow redesign, role-based automation, and seamless integration of virtual agents. Early results indicate notable efficiency improvements—around 9% in client-facing work and 8% in investment management—making AI a potential game-changer for profitability across the value chain.

Generative AI is streamlining core asset management functions, with notable efficiency gains in risk and compliance (about 5%) through automated regulatory interpretation, anomaly detection, and proactive oversight, and in technology (around 20%) via AI-assisted coding, debugging, testing, and IT service automation. These advances improve both operational speed and user experience.

However, capturing the full value of AI requires moving beyond isolated use cases to domain-level transformation, redesigning workflows end to end, and embedding AI as a strategic enabler across the business. Firms that address foundational gaps—such as fragmented systems, siloed initiatives, and outdated operating models—will be better positioned to lead.

Success depends on three pillars: adopting domain-based strategies with centralized governance and measurable ROI, revamping talent approaches to build AI literacy and integrate AI agents into workflows, and optimizing operating models to blend centralized oversight with decentralized innovation. Leading firms are also retaining control over their technology road maps, insourcing critical capabilities, and using reusable AI modules to standardize and scale adoption.

Anyway we saw a lot of interesting news this week. Ripple acquires Rails for $200 million, Brex secured an EU license to expand in the European Union, and Klarna eyes autumn window for the long awaited IPO. Mistral AI is targeting a $1 billion round, Bullish is looking to go public at $4.23 billion total valuation, and Booking.com just unveiled their first brand new credit card. In the VC industry we saw CRV closing a $750 million fund, Inflection Point Ventures launching a $110 million fund and Yaletown Partners launching a first $100 million fund. In the italian ecosystem AXA acquired Prima assicurazioni for $500 million. And finally, some very interesting funding rounds from fintech startups like Handwave, Alaan الآن, Saphyre, Rillet, Stavtar Solutions, Bit2Me, Capitolis and many others.

But let's take a closer look at the main news of the last seven days.

Closed deals

Handwave secures $4.2 million to bring Palm-based payments to Europe and the US

Saphyre raises $70 million to redefine trading operations with AI

QI Tech raises $63 million to cement its role in Brazil’s financial infrastructure race

Merso secures $3 million to launch AI lending platform for digital asset ecosystems

Common Wealth Retirement raises C$15 million to expand digital retirement services across Canada

Uzum Bank raises $70 million to accelerate fintech infrastructure and cement unicorn status in Uzbekistan

Alaan الآن raises $48 million to scale AI-powered spend management across MENA

GeoWealth raises $38 million to expand unified public-private investment portfolios for RIAs

Rillet raises $70 million Series B to redefine the financial core with AI-Native ERP

Blue J raises $122 million to redefine global tax research through Generative AI

Austria’s TACEO raises €4.8 million to scale secure computation infrastructure for the AI and Web3 era

Daloopa raises $13 million to build the gold standard for AI-ready financial data

OLarry raises $10 million to reinvent tax advisory with AI for the next generation of wealth

NG.CASH raises $26.5 million Series B to expand fintech platform for Brazil’s digital generation

Grasshopper Bank raises $46.6 million to fuel merger with Auto Club Trust and expand digital banking vision

Stavtar Solutions raises $55 million to modernize spend management for Hedge Funds and Alternative Asset Managers

Coinbase announces $2 billion convertible notes offering to fuel strategic flexibility

DPDzero raises $7 million to redefine debt collection in India with AI and ethics at the core

Clay raises $100 million at $3.1 billion valuation to power the future of AI-Driven sales automation

Approov Mobile Security secures £5 million to strengthen mobile app and API security against AI-driven threats

Tether.io backs Bit2Me in €30M Round to Drive Regulated Crypto Expansion

Capitolis secures $56 million to accelerate capital markets infrastructure innovation

Tracelight raises $3.6 million to bring generative AI into the heart of financial modelling

Docyt raises $12 million to scale precision AI for accounting automation

Insights on the VC industry

CRV closes $750 million Fund, refocuses on Early-Stage amid VC market shift

Cambridge Innovation Capital commits €115 million to supercharge DeepTech spinouts from University of Cambridge

Yaletown Partners secures first $100 million for Innovation Growth Fund III to power industrial tech transformation

Inflection Point Ventures launches $110 million cross-border fund

SIVentures (prev. Smart Infrastructure Ventures) launches €30 million SIVentures II to fuel B2B Tech innovation in DACH

JuCoin owned JuChain launches $100 million Genesis Ark program to accelerate Web3 ecosystem growth

News on the market

Klarna eyes autumn window for IPO comeback amid market rebound

Bling.de acquires Finstep (acquired by Bling) to boost financial literacy for the next generation

CACEIS backs Kriptown to launch Europe’s tokenised exchange for SMEs

Mistral AI targets $1 billion raise at $10 billion valuation to cement Europe’s AI sovereignty

Bullish targets $4.23 billion valuation in US IPO amid Pro-Crypto regulatory shift and stablecoin strategy

Booking.com enters the fintech arena with travel-focused credit card launch

Ripple to Acquire Rail for $200M, Strengthening Its Grip on Stablecoin Payments

Brex secures EU license, unlocking full-scale European expansion

A special look in the Italian market

AXA acquires 51% of Prima assicurazioni for €500 million, strengthening its digital foothold in Italy and Spain

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

Italian Tech Week - Turin | 1-3.10.2025 (link to event)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #92