Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

The latest episode of Builders has been released this week. In this episode, I sit down with Elias Apel, CEO of Lucanet. You can find the full episode here on youtube, or here on Spotify or here on Apple Podcast.

Elias has multiple years of experience in the financial industry, with experiences in IEG - Investment Banking Group and ARGONAS Corporate Finance Advisors. He joined Lucanet in 2018 as sales manager and then climbed the corporate ladder until becoming CEO in 2023. Take a look at a short clip from the full episode:

Lucanet is one of the major CFOs solutions providers, trusted by more than 5,000 companies globally, with multiple locations around the world and more than 800 employees.

During this interview, recorded during Lucanet 2025 in Berlin, we’ve been talking about his experience going from sales to CEO, the opportunity and challenges in the fintech space, but also the importance of ESG in financial decisions and the impact of AI in his day-to-day operations.

This was also the last episode for season 2! The podcast will take a very well earned pause in August and come back in September for season 3. Let me know who would you like to see as a guest and get in touch with me if you think you could be a good fit!

Coming back to us, I was reading a very interesting report this week, the “State of Fintech - Q2 Global 2025” from CBS Insights . The report is a very comprehensive analysis of investments in fintech in Q2 2025, with a focus on regions, verticals and deals. Here my main takeaways:

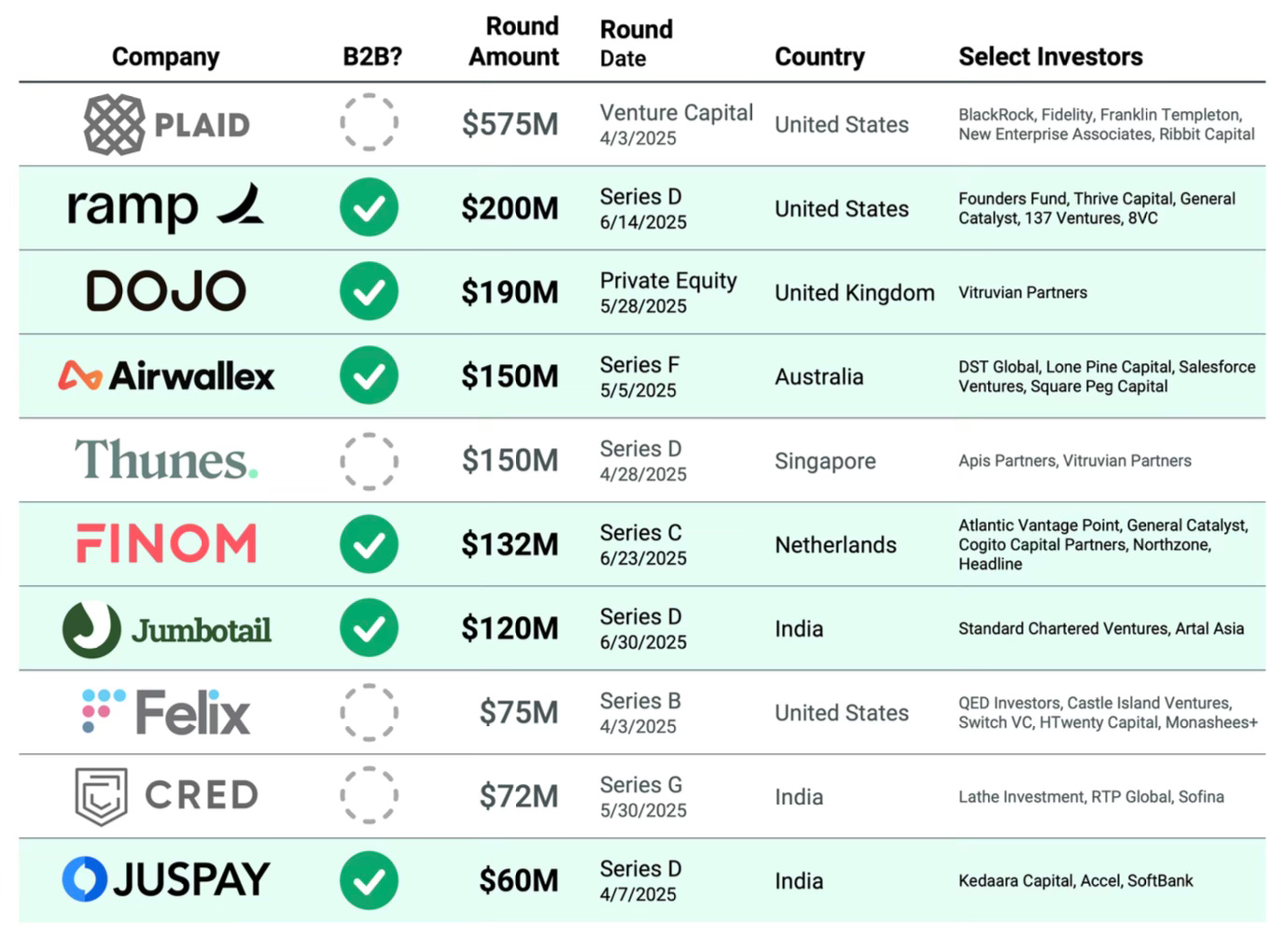

For the first time since early 2023, fintech funding has surpassed $10 billion for two consecutive quarters. The biggest deal this quarter was the $575 million investment in fintech infrastructure giant Plaid. However, despite these recent peaks, overall funding is still significantly lower than in 2022.

In Q2 2025, the US reached record levels of dominance in fintech, accounting for 65% of all mega-rounds and 43% of total deal volume—both historic highs. The country also attracted 70% of mega-round funding and 60% of total fintech investment, underlining investors’ growing preference for US-based fintech ventures.

B2B fintech firms played a central role, securing 60% of the largest payments investments and half of the top banking rounds. Among the standout deals were Ramp ’s $200 million Series D and Dojo’s $190 million private equity round. Obviously the report didn’t accounted for some recent deals, like Ramp raising $500 million last week.

Wealth tech funding reached $1.9 billion in Q2 2025, marking its highest level since Q2 2022. This figure represents nearly three times the amount raised in Q1 ($700 million), signaling the sector’s strongest quarter in three years. Major deals, including Addepar ’s $230 million raise and Groww ’s $200 million Series F, significantly lifted both average and median deal sizes.

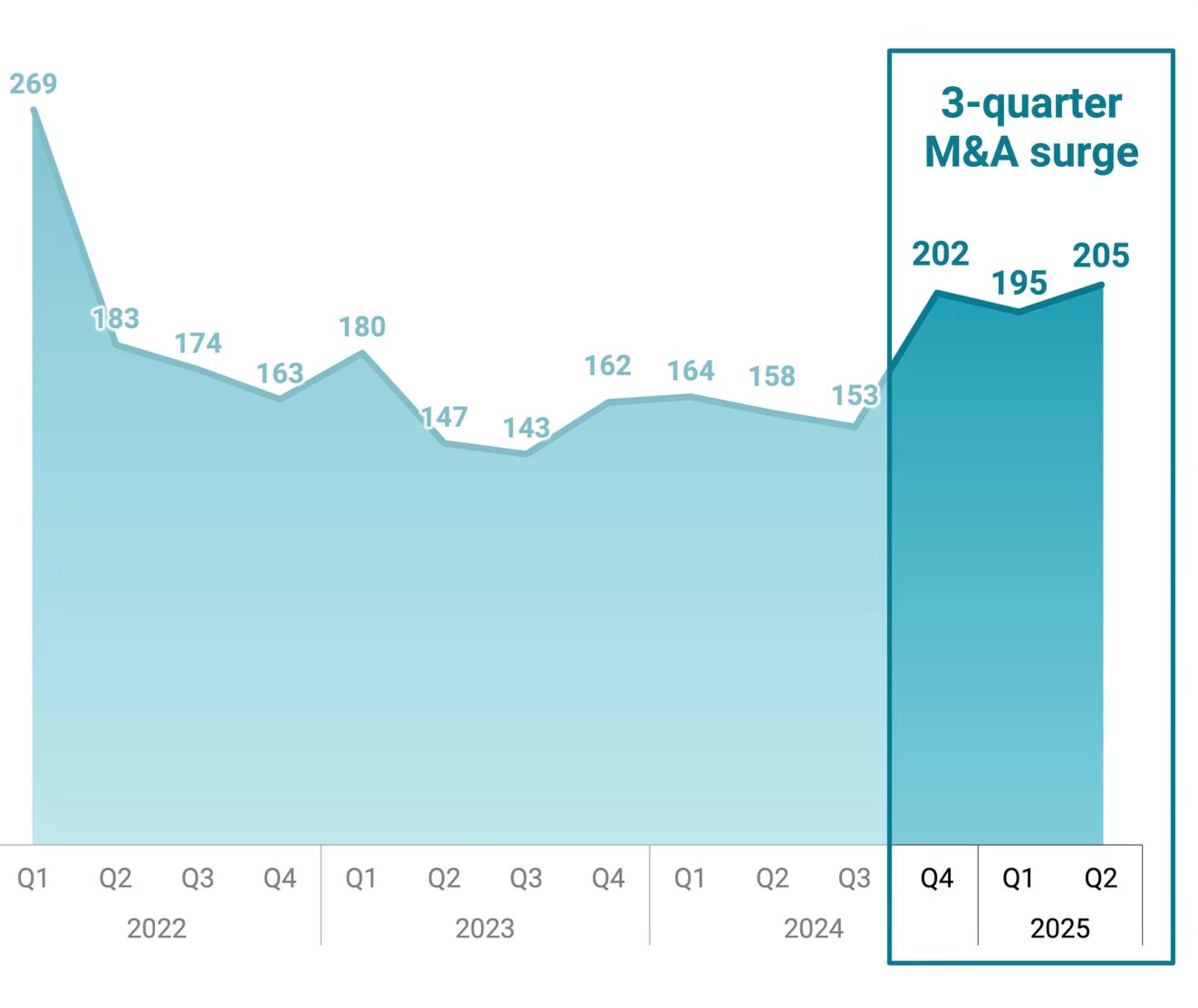

Fintech M&A activity remained elevated for the third consecutive quarter, reaching 205 deals in Q2 2025—a continuation of the sharp rise that began in Q4 2024. Digital assets remain a key driver of exit momentum, highlighted by Circle ’s public listing at a $6.9 billion valuation, Stripe ’s acquisition of Privy, and Coinbase’s $2.9 billion acquisition of Deribit.

Anyway we saw a lot of interesting news this week. Revolut always on the rise, this week they announced a partnership to sponsor AUDI AG future F1 team, while pitching a possible expansion in China to investors. Ramp raised $500 million at a $22.5 billion valuation, Kraken is reported in talks to raise $500 million at a $15 billion valuation and n8n is looking to raise $300 million at $1.5 billion valuation. J.P. Morgan partners with Coinbase to offer crypto access to +80M users in the US, while trying at the same time to replace Goldman Sachs in the Apple card deal, and PayPal released “Pay with Crypto”. In the venture industry, Blackwood Ventures raised a $25 million debut fund and Deciens Capital announced the closing of a third $93.3 million fund. In the italian ecosystem, Trustfull raised $6 million for its AI-powered fraud prevention platform. And finally, some very interesting funding rounds from startups like Trovata, Delve, Salient, Due, OffDeal, Quartr and many others.

But let's take a closer look at the main news of the last seven days.

Closed deals

OSL Group secures $300 million to fuel stablecoin ambitions and global expansion

Trovata raises $9 million and acquires ATOM to usher in a new era for treasury tech

Delve raises $32 million at $300 million valuation to reinvent compliance with AI agents

Salient raises a $60 million Series A to revolutionize loan servicing with AI-first automation

Zodia Markets secures $18 million to expand stablecoin FX solution and institutional crypto reach

Due extends Seed round to $7.3 million and launches stablecoin API to redefine global payments

Ramp raises $500 million at $22.5 billion valuation to build the autonomous future of finance

OffDeal raises $12 million to build AI-native investment bank for small business exits

Quartr raises $10 million to expand global reach as demand for public market insights surges

D2X Group raises $5 million to scale Europe’s first regulated 24/7 crypto derivatives Exchange for Institutions

Wingspan raises $24 million Series B to power the future of contractor-centric HR platforms

Bitzero Blockchain Inc raises $25 million to scale sustainable crypto mining with hydropowered data centers

Hong Kong’s RD Technologies raises $40 million to advance stablecoin infrastructure

Tether.io-backed chain Stable raises $28 million to launch first “Stablechain” for real-world USDT payments

Noma Security raises $100 million to secure AI agents for corporates

Jitty - jitty.com raises £2.8 million to redefine proptech with AI-powered home discovery

Insights on the VC industry

Blackwood Ventures closes a $25 million debut fund to back Europe’s boldest early-stage founders

Deciens Capital closes $93.3 million Fund III to back the future of financial services

News on the market

Cleo doubles revenue, hints at IPO as AI fintech nears $500 million ARR

PayPal releases crypto payments into the Mainstream with “Pay with Crypto” rollout

Airwallex launches Yield in Singapore with MAS approval, expanding fintech treasury solutions

NiCE to acquire Cognigy for $955 million in Europe's biggest exit in AI

NatWest partners with PEXA to digitize UK remortgages, paving way for faster, safer property deals

Germany’s n8n targets $1.5 billion valuation in a possible $300 million round

TPG eyes stake in Tide as UK fintech nears $1 billion valuation amid global SME expansion

J.P. Morgan puts Gemini partnership on hold as fintech data fees spark industry backlash

Kenro Capital eyes $30–40M Stake in IPO-bound Pine Labs ahead of major exit round

Revolut pitched possible China expansion to investors, including licensing

Coinbase and J.P. Morgan partner to bridge traditional finance and crypto for 80M+ users

Could Anthropic be worth $170 billion?

Checkout.com and Visa join forces to launch card issuing for European merchants

J.P. Morgan set to replace Goldman Sachs as Apple Card Issuer

Kraken reported in talks for a $500 million raise at $15 billion valuation ahead of potential 2026 IPO

Worldline to divest €450 million MeTS unit in €410 million deal with Magellan Partners to refocus on core payments business

FIS partners with Circle to bring USDC payments to U.S. banks in wake of stablecoin legislation

Figma makes its public market debut at $19.3 billion valuation after blockbuster IPO

Revolut eyes potential bank acquisition in the Middle East to speed up regional expansion

A special look in the Italian market

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

Italian Tech Week - Turin | 1-3.10.2025 (link to event)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #91