Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

The latest episode of Builders has been released this week. In this episode, I sit down with Oliver Hughes, Head of international business at TBC Bank Group PLC. You can find the full episode here on youtube, or here on Spotify or here on Apple Podcast, but first take a look at a short clip:

Oliver has multiple years of experience in fintech and banking, with the life of a real globetrotter in this field. Starting his career in Visa, he went on becoming Head of Russia for the US giant, handling operations in the country for almost a decade. After this experience, he jumped on the fintech train, becoming CEO of Tinkoff in Russia, leading the expansion of one of the most profitable digital banks in the world, building the team behind it from scratch.

Finally, he recently became head of international business at TBC Bank Group, the leading digital bank in Uzbekistan, one of the most interesting digital banks in central Asia. With him, we will talk about a decade of experience of fintech between Russia and Asia, the growing economy of Uzbekistan, the differences between financial services in the region.

Coming back to us, I was reading a very interesting report this week, the “State of fintech in the Middle East” by Lucidity Insights. The study goes through a market composed by more than 1,500 fintech startups, with $4.2 billion in funding in 2023, 7 IPOs and 30+ exits by M&A, drawing a very interesting picture of a growing powerhouse. Here my main takeaways:

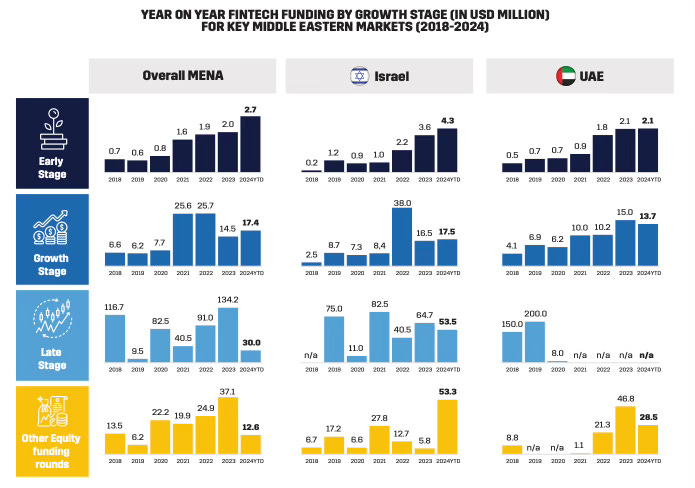

The data set reveals that early-stage fintechs across the region have consistently seen increases in average deal sizes, indicating growing investor confidence and market depth. In the growth stage, funding dynamics vary: each country reached its peak at different moments, with 2023 emerging as a standout year for most of them. When it comes to late-stage investments, the landscape becomes even more fragmented. Israel shows a more mature ecosystem, underpinned by a longer-established fintech sector. In contrast, several late-stage UAE fintechs have strategically relocated their headquarters to Saudi Arabia in pursuit of capital access and IPO pathways. Meanwhile, markets like Egypt and Turkey remain too early in their ecosystem development to register any notable late-stage fintech funding, highlighting how the definition of “nascent stage” varies significantly across the region.

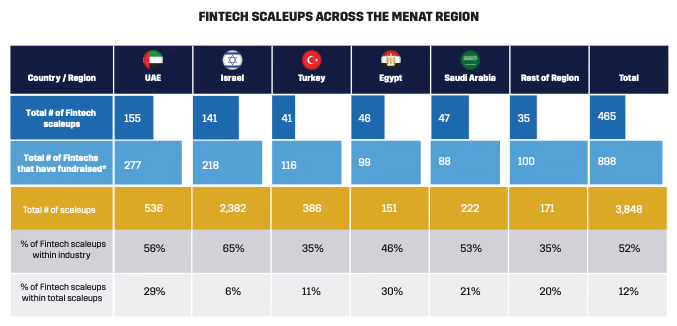

The UAE currently leads the region with 155 fintech scaleups that have each raised over US $1 million, surpassing even Israel, a country widely recognized as a global hub for fintech and cybersecurity innovation. While the number of scaleups doesn't necessarily equate to quality, this shift signals growing momentum in the UAE, especially as fintechs from around the world—including Israeli firms—continue relocating their headquarters to Dubai. Still, this is not a decisive lead. Israel remains a close second with 141 such fintechs, while Turkey, Egypt, and Saudi Arabia follow at a greater distance, with 41, 46, and 47 scaleups respectively. The UAE’s position can likely be attributed to a combination of factors: a favorable business environment, the widespread use of English in professional settings, a highly international talent base, and a transparent financial regulatory framework—all of which contribute to making the country a compelling destination for well-funded fintech ventures.

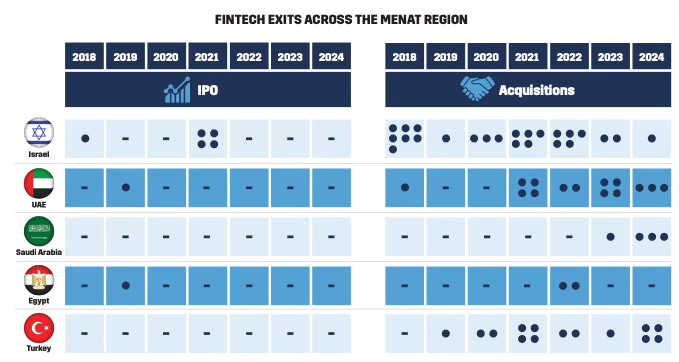

Over the past six years, the fintech sector across the Middle East and Turkey has seen a total of 66 exits, with just 7 of those taking the form of IPOs. The predominant exit route for startups in the region remains acquisitions and buyouts. Israel stands out with the highest number of successful exits at 29 since 2018, followed by the UAE with 15 and Turkey with 14. When it comes to public listings, only three markets—Israel, the UAE, and Egypt—have seen fintech startups successfully complete an IPO during this period, underscoring how limited that path remains in the regional landscape.

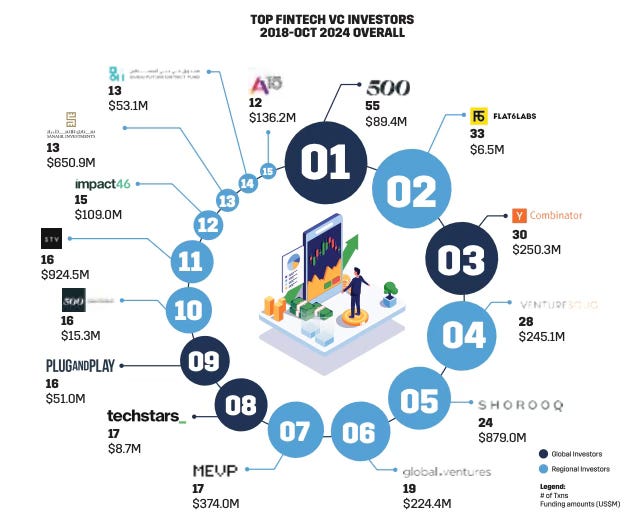

The Middle East, Africa, and Turkey fintech ecosystem is supported by a diverse and active investor base, ranging from regional incubators and accelerators to international venture capital firms. Regionally established programs such as 500 Global, Techstars, Plug and Play Tech Center, and Flat6Labs contribute significantly to investment volumes due to the high number of startups passing through their platforms each year. Even Y Combinator has made a notable impact—deploying over US $250 million across 30 fintech startups in the region over the past six years.

From 2018 through Q3 2024, Saudi Arabia’s STV stands out as the largest fintech investor in the region by capital deployed, with more than US $924 million invested in 16 startups. This leadership position reflects STV’s late-stage focus, typically backing companies at Series B or beyond, where ticket sizes are substantially higher. Shorooq Partners in Abu Dhabi follows closely, having invested US $879 million across 24 fintechs, with a concentration on Seed to Series A stages. In third position is Dubai-based MEVP, with US $374 million deployed over 17 deals, focusing primarily on growth-stage investments at the Series A level.

Anyway we saw a lot of interesting news this week. The news of the week is surely the crazy round from Lovable, which achieved unicorn status after a $200 million series A. But we also saw Windsurf deal with OpenAI collapsing when Google proposed an acquihire for $3 billion. Coinbase rebranded the wallet as Base, a step forward a new superapp in crypto, OpenAI released a checkout feature for ChatGPT and Google released a cobranded credit card in India. Lots of movement in the VC space, with Matt Miller launching a $400 million fund, followed by Kris Fredrickson with a $175 fund and Cambrian by Rex Salisbury with a $20 million fund. But also Eurazeo, Nzyme and Mantis Venture Capital. In the Italian market, Bending Spoons completed yet another acquisition adding MileIQ to its portfolio of softwares. And finally, some very interesting funding rounds from fintech companies like Two, dakota, Murphy AI, Candex, Spiko, Paypercut, yetipay and many others.

But let's take a closer look at the main news of the last seven days.

Closed deals

Norwegian fintech Two secures €13 million to accelerate global B2B payments transformation

zerohash secures $100M to reach unicorn status and accelerate crypto-tradFi integration

Barcelona’s Murphy AI raises $15 million to reinvent debt collection with AI agents

dakota raises $12.5 million to merge stablecoins and banking for global businesses

Berlin’s re:cap secures €125 million to launch its Capital OS for UK tech companies

German HRTech Ordio secures €12 million to revolutionize payroll automation for Europe’s deskless workforce

Candex raises $33 Million Series C to scale tail spend management as global demand surges

Heka raises $14 Million to redefine identity intelligence for banks amid record fraud losses

Spiko raises a $22 Million Series A led by Index Ventures

Lovable hits unicorn status with $200M Series A just 8 months after launch

Paypercut raises €2 million to unify BNPL access for small merchants across Europe

yetipay raises £3.5M to scale its all-in-one payments platform and challenge industry giants

PayU India raises ₹302 Crore from Prosus Group to accelerate credit business turnaround

Retirable raises $10 million Series A to serve US’s overlooked retirees with personalized financial planning

Paddle secures $25 million to power global expansion in the digital monetization race

NG.CASH raises $26.5 million to fuel generation Z’s demand for credit in Brazil

Insights on the VC industry

Former Sequoia Capital Partner Matt Miller raises a $400 million fund to bet on European innovation

Nzyme closes a €160 million fund to drive digital transformation of Spanish SMEs

Former Coatue investor Kris Fredrickson launches $175 Million fund to back AI’s next generation

The Chainsmokers’ Mantis Venture Capital secures $100 Million for third fund to back B2B innovation

Cambrian Ventures raises second $20 Million fund to bet big on fintech’s next chapter

Eurazeo secures €650 Million for new AI growth fund, eyes €1 billion to back Europe’s next scaleup champions

News on the market

Windsurf’s leadership heads to Google as $3 billion OpenAI Deal Collapses

Lloyds Banking Group in advanced talks to acquire Curve, strengthening Its digital payments ambitions

Vivid Money enters Spain with Spanish IBAN and 4% returns for businesses and freelancers

MoonPay partners with Revolut to let user buy crypto using Revolut Pay

Starling Bank is considering New York for the IPO in latest blow to EU public markets

Rydoo acquires Semine to build Europe’s most advanced finance automation platform

Cash App launches Tap to Pay on iPhone, unlocking contactless payments for over a million sellers

Checkout.com expands in North America with Canadian launch and 80% U.S. growth

Plaid partners with Xero to transform US bank feeds for over a thousand financial institutions

Google Pay plans co-branded credit card with Axis Bank as fintech giants double down on credit to boost revenue

OpenAI eyes eCommerce revenue with new ChatGPT checkout feature

Coinbase rebrands wallet into Base App, launches its own crypto “Everything App”

U.S. House of Representatives greenlights landmark Crypto legislation before recess

A special look in the Italian market

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

European women in Tech - Amsterdam | 25-26.06.2025 (link to event)

Italian Tech Week - Turin | 1-3.10.2025 (link to event)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #89