Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

No episode of Builders this week, but you can always recover the last one where I sat down with Saskia Bruysten , Partner and Co-founder at Carbon Equity. You can find the full episode here on youtube, or here on Spotify or here on Apple Podcast.

Saskia is an impact entrepreneur and investor. In her current role as Partner & Co-Founder International at Carbon Equity, she leads the platform's global expansion, democratizing private equity investments in climate tech to make them accessible to a broader audience. Carbon Equity is the world's most active climate tech LP.

Previously, Saskia co-founded and served as CEO of Yunus Social Business (YSB) alongside Nobel Peace Prize Laureate Prof. Muhammad Yunus. Under her leadership, YSB scaled social businesses that improved the lives of over 17 million people in East Africa, Latin America & India, providing access to employment, education, healthcare, and clean energy.

With her, we will talk about the latest trend in climate tech, nuclear energy, but also how VC invests in this field and how to choose a great founder with a world changing tech.

Coming back to us, I was reading a very interesting report this week, “The future of global fintech: from rapid expansion to sustainable growth”, from the University of Cambridge and the World Economic Forum. The research draws on data from 240 fintech firms spanning six industry verticals and six geographical regions. With respondents headquartered in 59 jurisdictions and operating in 109 countries, the findings offer a comprehensive and diverse snapshot of the global fintech industry. Here my main takeaways:

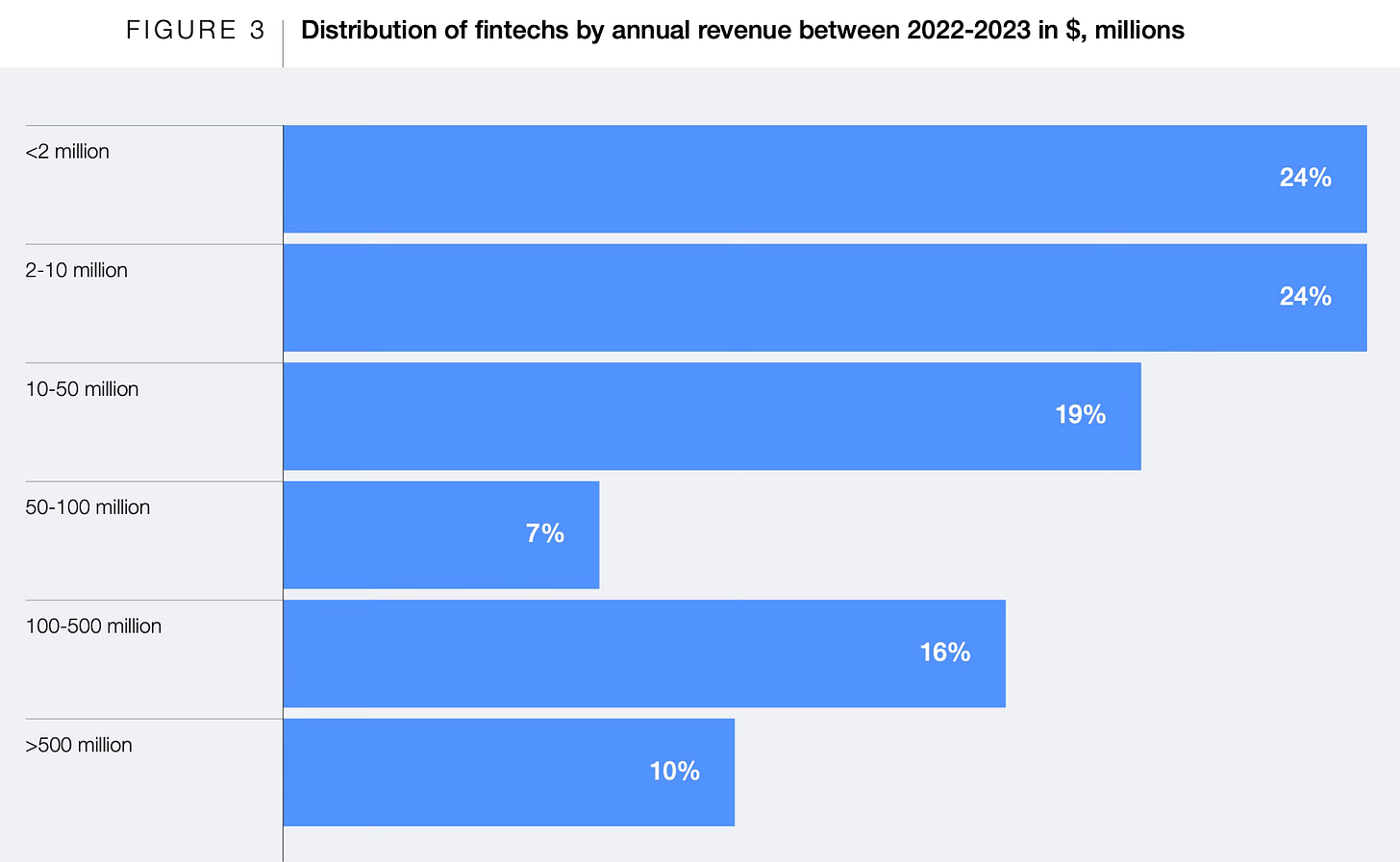

Between 2022 and 2023, nearly half of fintech companies reported annual revenues between under $2 million and $10 million, with each range accounting for 24% of firms. About 26% generated revenues between $10 million and $100 million, while 16% fell into the $100-500 million bracket, and 10% exceeded $500 million annually, indicating a predominance of firms with modest but relevant revenue bases.

When comparing advanced economies (AEs) and emerging markets and developing economies (EMDEs), 23% of fintechs in AEs and 26% in EMDEs earned less than $2 million. AEs had a greater concentration in the $2-10 million and $10-50 million ranges, whereas EMDEs recorded a larger share in the $100-500 million segment.

Across sectors, revenues under $2 million were especially common outside digital payments and lending. In digital capital raising, 63% of companies reported earning less than $2 million, while this applied to 41% of wealthtech and 36% of digital banking and savings providers. Digital payments firms stood out, with most reporting revenues between $2-10 million and a small fraction achieving $100-500 million.

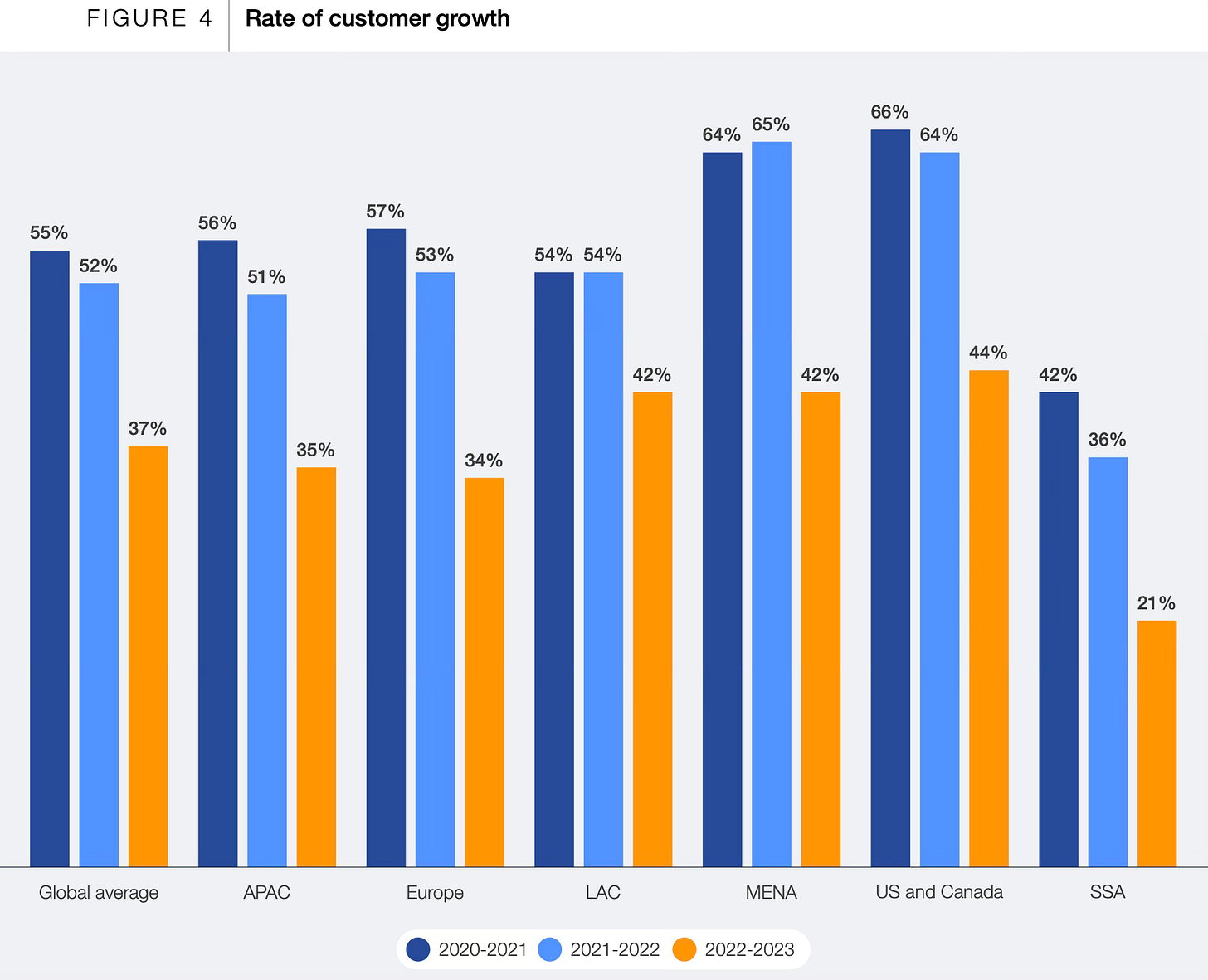

Since 2020, data gathered for the Future of Global Fintech initiative has traced the industry’s remarkable expansion. The latest survey showed that fintechs maintained strong performance, achieving an average customer growth rate of 37% between 2022 and 2023. However, this marked a clear slowdown compared to previous years, when growth reached 55% in 2020-2021 and 52% in 2021-2022.

This decline in growth rates has been evident across all regions and segments, reflecting a normalization after the surge in digital financial adoption during the pandemic. As the market matures, fintech companies are shifting their focus from aggressive customer acquisition toward enhancing their offerings and cultivating stronger relationships with existing users.

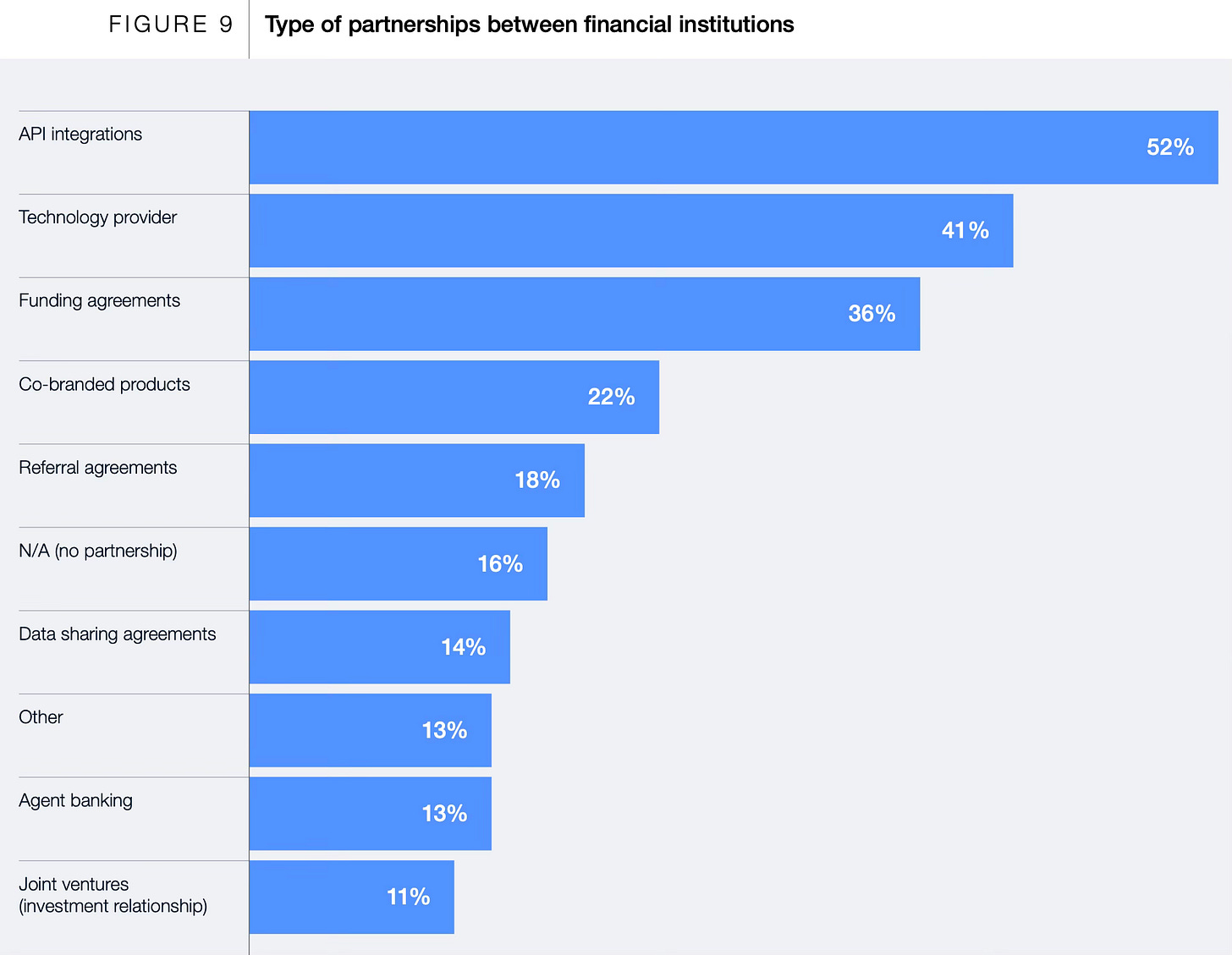

An overwhelming 84% of fintechs reported working with incumbents, underscoring how essential such alliances have become.

API integrations emerged as the most common form of partnership, cited by 52% of respondents, illustrating the sector’s dependence on smooth technological connectivity. This preference mirrored the widespread belief that open banking and open finance frameworks fuel business growth, even though 12.5% of firms with API partnerships operated in markets lacking such frameworks. These integrations mainly facilitated payments, purchase transactions and cross-border transfers. API collaborations were particularly widespread in the MENA region and among wealthtech and digital payment providers.

Beyond APIs, partnerships with technology providers were also significant, reported by 41% of fintechs, highlighting the importance of third-party solutions in daily operations. Funding agreements were the third most common partnership type at 36%, reflecting how critical financial collaborations remain, especially in Sub-Saharan Africa, where more than half of fintechs cited limited access to capital as a major hurdle.

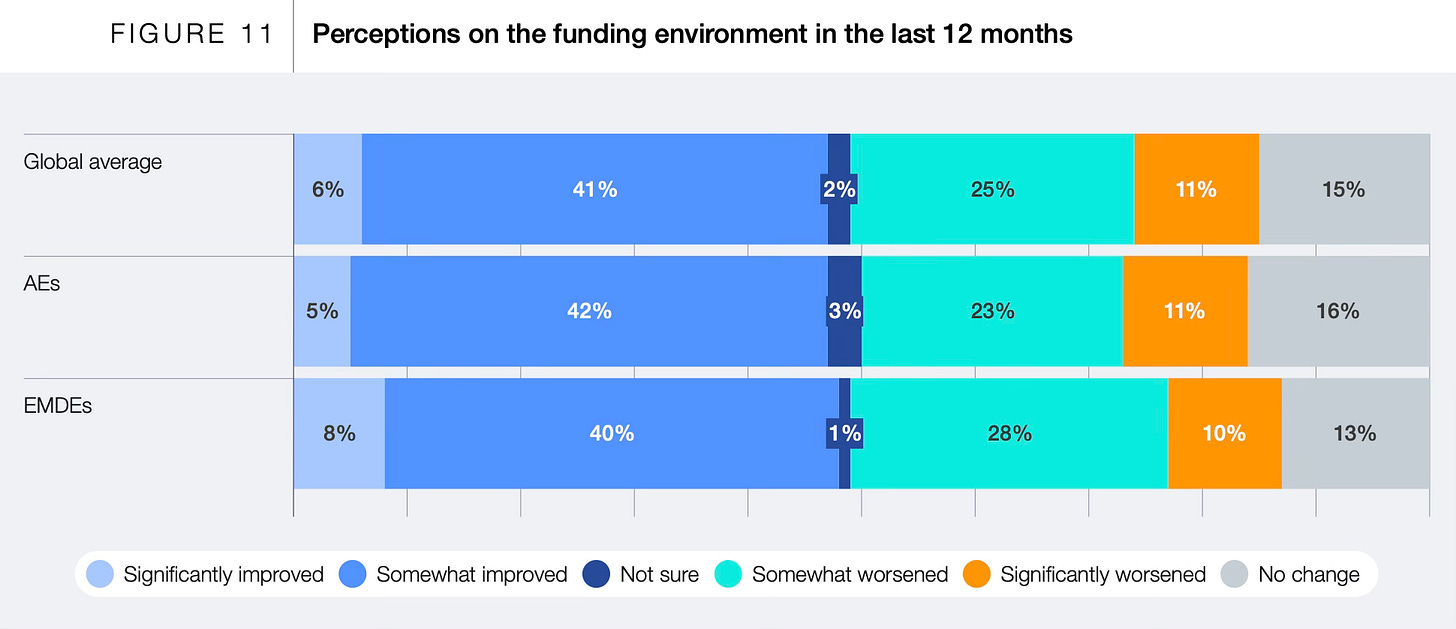

Overall, 47% of fintechs indicated that funding conditions had somewhat or significantly improved. Slightly more firms in emerging markets and developing economies (EMDEs) perceived significant improvement compared to those in advanced economies (AEs), at 8% versus 5%. Nonetheless, many also experienced setbacks: 38% of fintechs in EMDEs and 34% in AEs reported that funding conditions had worsened. These results reflect the broader market correction since 2022, with fintech investment dropping to a seven-year low by 2024.

Perceptions varied by region and sector. Fintechs in Sub-Saharan Africa were especially negative, with over half reporting a deterioration in funding conditions. Among segments, wealthtech saw contrasting views, as 23% noted a significant decline while nearly half saw some improvement. Insurtech firms were the most optimistic, with 66% perceiving better funding availability.

Anyway we saw a lot of interesting news this week. Revolut always made it to the headlines, first launching a partnership with Ant International to support payments to China using Alipay, then reported in talks to raise additional funds at a $65 billion valuation. Monzo Bank was fined $21 million from the FCA, TBC UZ launched a fully digital insurance solution, and Stitch acquired Efficacy Payments (PTY) Ltd to build a card processing powerhouse in Africa. But we also saw Alpaca acquiring WealthKernel and Circle partnering with Ant Group on stablecoins. In the VC ecosystem, a lot of new funds this week, starting from Arāya Ventures with their $26.3 million debut fund, but also Red Dot Capital Partners with a $320 million fund and boldstart ventures with a $250 million fund. And finally, some very interesting funding rounds from fintech startups like Gradient Labs, Cariqa, Castellum.AI, Huspy, RedCloud, Bilt, Agora and many others.

But let's take a closer look at the main news of the last seven days.

Closed deals

The Open Platform raises a $28.5 million Series A, paving the way for wallet integration in Telegram Messenger

Gradient Labs secures $13 million to redefine AI for regulated industries

Cariqa raises €4 Million to streamline EV charging payments across Europe

Castellum.AI secures $8.5 Million to revolutionize financial crime compliance with AI

Huspy raises $59 Million to accelerate European expansion and reinvent digital home buying

RedCloud raises $13.5 Million to drive AI-powered B2B Commerce in emerging markets

Modern World Business Solutions secures £9 million to redefine merchant payments across the UK

Moment secures a $36 million series B to bring AI automation to fixed income trading

Nominal raises $20 million to power financial operations with AI agents

Bilt secures $250 million at $10.75 billion valuation to reinvent how americans do house payments

Agora captures $50 million Series A to power the next wave of stablecoin adoption

Insights on the VC industry

Arāya Ventures raises $26.3 million for the final close of its debut fund

Red Dot Capital Partners closes $320 Million fund to propel Israeli early-growth tech companies

Alliance VC secures €40 million first close to back next wave of Nordic early stage startups

AN Venture Partners closes $200 Million debut fund to catalyze global biotech innovation

boldstart ventures closes $250 million Fund VII to back the next wave of autonomous enterprise builders

Propel Venture Partners raises $100 Million to back the next generation of fintech innovators

News on the market

Why didn't Revolut received their credit license from UK regulators yet?

Shift4 completes the $2.5 Billion acquisition of Global Blue

Five Belgian banks join European Payments Initiative to expand Wero’s reach

ZAP launches Zap Cashier to transform payments in Gaming and eCommerce in collaboration with TrueLayer

Revolut partners with Ant International to let their customers send money to China using Alipay

Mubadala eyes $100 million additional stake in Revolut as valuation climbs past £33 billion

Monzo Bank fined £21 million over failures in financial crime controls

TBC UZ rolls out fully digital insurance, reinforcing its leadership role in Central Asian fintech

Revolut launches Stocks and Shares ISAs and ETFs for UK Customers

Stitch acquires Efficacy Payments (PTY) Ltd to build end-to-end card processing powerhouse in South Africa

Jack Dorsey unveils Bitchat, an encrypted bluetooth messaging app for decentralised communication

Mastercard and Pay4You join forces to tackle tail spend across Europe

Tether.io reveals $8 Billion gold reserve in Swiss vault, matching UBS exposure

Clarity AI acquires sustainability fintech ecolytiq to deepen insights across global finance

Revolut is reported raising funds at $65 Billion valuation

Alpaca acquires WealthKernel to build a global brokerage platform

Ant Group joins forces with Circle to bring stablecoins to cross-border payments in China

Ramp unveils autonomous AI agents to revolutionize finance operations

A special look in the Italian market

-

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

European women in Tech - Amsterdam | 25-26.06.2025 (link to event)

Italian Tech Week - Turin | 1-3.10.2025 (link to event)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #88