Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

No episode of Builders this week, but you can always recover the last one where I sit down with Chris Harmse, Co-founder of BVNK. You can find the full episode here on youtube, or here on Spotify or here on Apple Podcast.

Chris is native from South Africa, where he also started his career in finance, starting at Renaissance Capital, Rezco asset management and most importantly the trading desk of fixed income at BNP Paribas .

He then went on working in the hedge fund industry, at Asymmetry Asset Management and Excelsia Capital . During this experience he discovered the world of crypto and stablecoin, and that was the push that led him to launch BVNK. BVNK builds enterprise-grade payments infrastructure for stablecoins, and is one of the biggest payments providers in this industry, with more than 300 employees and over $12 billion in transactions managed.

With him, we will be talking about his experience coming from South Africa to London and San Francisco, his take on the fintech market, and most importantly the present and future for stablecoin.

Coming back to us, I was reading a very interesting report this week, the “Founders vs Investors: two faces of fintech funding” from EY . The report is a very interesting study on the Italian fintech ecosystem, trying to understand factors, trends and main variables driving growth in one of Europe’s more interesting ecosystems. Here my main takeaways:

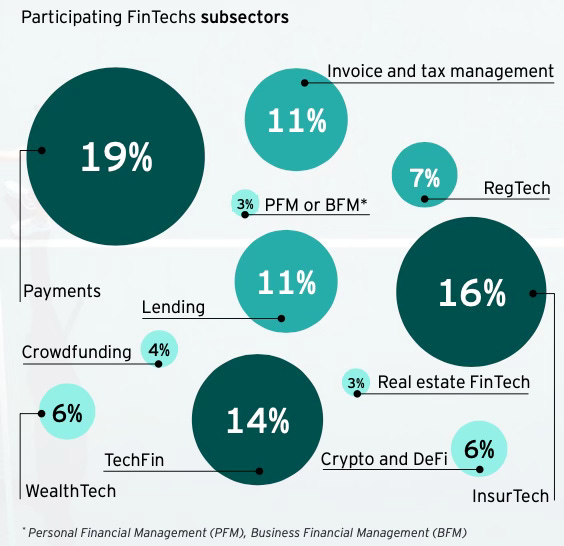

Let’s start from the basics: the sample itself. Approximately 49% of the FinTech companies analysed are active in the payments, InsurTech and TechFin segments, and 78% of them have adopted a B2B business model. Most of these firms focus exclusively on the Italian market and are still at an early stage of growth, with 59% situated in either the seed or pre-seed phases.

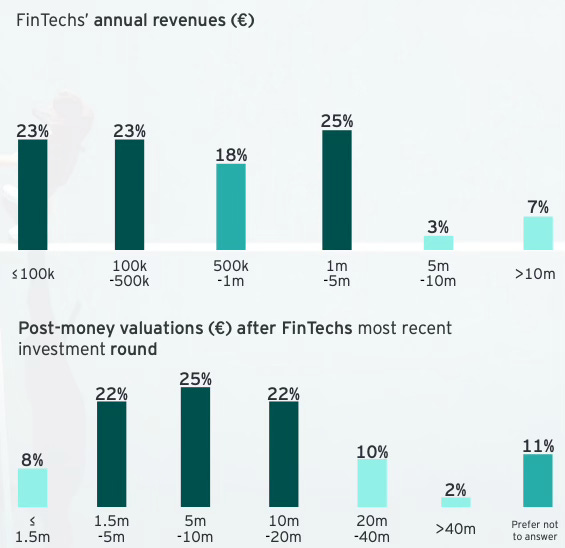

Their post-money valuations generally fall between €5 million and €10 million. Regarding funding, nearly 47% have raised under €1 million, while an additional 21% have secured financing between €1 million and €3 million. Revenue remains limited across the sector, as 64% of the companies report annual turnover below €1 million.

Most companies remain in the early stages of development, with 45% in the seed phase and 14% still pre-seed. Only 8% have reached Series B funding, while a small share of 4% has advanced to Series C or beyond. In terms of capital raised, nearly half of the founders have secured less than €3 million, with 20% having raised under €200,000 and 21% collecting between €1 million and €3 million. Post-money valuations largely cluster between €1.5 million and €20 million, with 69% of respondents falling into this range after their most recent investment rounds.

Revenue generation remains modest: almost half of the companies report annual revenues below €500,000, while only 10% exceed €5 million. These findings illustrate a predominantly early-stage ecosystem where funding and scale are still developing, but with a share of firms beginning to reach more substantial revenue and valuation milestones.

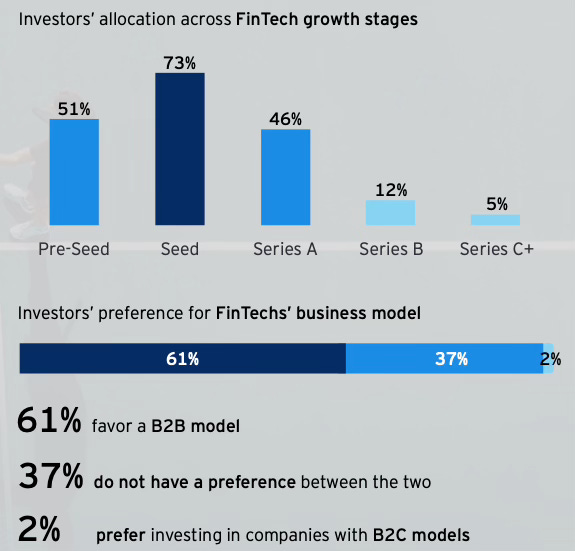

On the investors side, venture capital firms representing 60% of the sample, offering a thorough view of the investment environment. A significant majority, 79%, are active both in Italy and abroad, enabling valuable comparisons across regions. Investors display a pronounced interest in the payments and InsurTech segments, each attracting 54% of respondents, followed by lending at 46%.

Their activity is concentrated in early-stage funding, with 73% favouring seed rounds and 51% engaging in pre-seed deals, while 61% focus on B2B business models. Approximately 75% of investors hold between one and five Italian FinTech companies in their portfolios, indicating a relatively selective approach. Regarding investment amounts, most tickets are below €1 million, with 32% under €200,000.

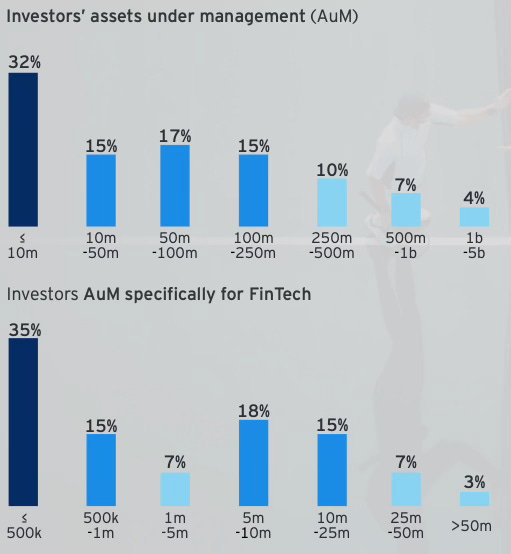

About 32% of investors manage less than €10 million in total assets, while 17% control between €50 million and €100 million. Specifically for FinTech, 35% allocate under €500,000, and 18% dedicate between €5 million and €10 million. FinTech portfolio exposure remains selective, as 75% of investors hold between one and five FinTech companies, and only 5% maintain stakes in more than 20 firms.

Investment sizes are generally modest: 32% of investors typically deploy tickets below €200,000 per deal, and 27% invest between €200,000 and €500,000, with just a small minority committing over €5 million. This profile suggests that most investors pursue a cautious, incremental approach to FinTech allocations, focusing on early-stage investments with controlled risk exposure.

Anyway we saw a lot of interesting news this week. Revolut making the news again, as they are set to acquire Argentina based Cetelem, while Worldline had an horrible week with shares plunging more than 20% after accusations of frauds cover up. Xero acquired payment platform Melio for $2.5 billion, Mastercard joined Paxos stablecoin network, and Kraken Digital Asset Exchange launched its peer-to-peer solution, Krak. In the VC ecosystem, we saw Project A launching a $325 million fund to back european founders, but also new funds from Movens Capital, KAYA VC and Kiara Capital. In the italian ecosystem Sibill raised a crazy $12 million round led by Creandum. And finally, some very interesting funding rounds from fintech startups like Finom (congrats Konstantin Stiskin!), Spinwheel, Stackup, Skarlett, Quinn, Kalshi, Meridian and many others.

But let's take a closer look at the main news of the last seven days.

Closed deals

Finom secures €115 million series C to redefine SMB banking in Europe

Spinwheel raises a $30 million series A to reshape U.S. consumer credit infrastructure with AI

Nook raises $2.5 million to simplify crypto lending for the mass market

Stackup raises $4.2 million to streamline financial workflows for crypto businesses

Veda raises $18 million to advance crosschain yield and stablecoin innovation

Equivator® invests SAR 30 million in Related to build MENA’s loyalty and rewards powerhouse

Skarlett raises €8 million to redefine financial services for France’s 60+ generation

Digital Asset raises $135 million to accelerate Canton Network and institutional tokenization

Quinn raises $11 million to revolutionize scalable wealth advisory with AI-driven platform

Kalshi raises $185 million to cement its leadership in U.S. prediction markets

Conquest Planning raises $80 million to scale AI-driven financial advice across North America

Blueprint Finance secures $9.5 million to scale multi-chain DeFi infrastructure

IndiaBonds raises $3.77 million to accelerate bond market access for Indian investors

Meridian raises $7 million to redefine private equity deal sourcing with AI

Insights on the VC industry

Movens Capital launches €60 million fund 2 to fuel tech innovation in Europe

Project A closes a €325 million Fund V to back Europe’s earliest tech ventures from day zero

KAYA VC launches a €70 million fund to back the next wave of CEE startup leaders

Norrsken commits €300 million to back Europe's next generation of 'AI for good' startups

Kiara Capital launches $40 million fund to back early-stage fintech in Latin America

News on the market

Fiserv launches FIUSD Stablecoin and a new digital assets platform

Shift4 acquires SmartPay for $180 million to expand POS and payment offerings across ANZ

NYK Line acquires Kadmos to expand fintech services for seafaring workers globally

Klarna is now available on Google Pay

Zopa Bank launches UK current account named ‘Biscuit’ to compete with Revolut and Starling Bank

Revolut’s CEO eyes multibillion-dollar windfall as company targets $150B valuation

Xero to acquire payments platform Melio for $2.5 billion to strengthen US expansion

Worldline shares plunge amid allegations of fraud concealment in high-risk client portfolio

Mastercard joins Paxos’ network to scale stablecoin adoption globally

Beijing will launch a Yuan-pegged stablecoin test in Hong Kong

Kraken Digital Asset Exchange expands into Peer-to-Peer payments with launch of Krak App

Barclaycard joins UK banks in blocking crypto purchases with credit cards

SoFi reenters crypto with new services and blockchain remittances

Revolut is set to acquire Argentina’s Cetelem to strengthen Latin American presence

A special look in the Italian market

Sibill secures a €12 million Series A to digitize financial management for Italian SMEs

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

European women in Tech - Amsterdam | 25-26.06.2025 (link to event)

Italian Tech Week - Turin | 1-3.10.2025 (link to event)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #86