Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

The latest episode of Builders has been released this week. In this episode, I sit down with Chris Harmse, Co-founder of BVNK. You can find the full episode here on youtube, or here on Spotify or here on Apple Podcast. But just take a look at a short clip first:

Chris is native from South Africa, where he also started his career in finance, starting at Renaissance Capital, Rezco asset management and most importantly the trading desk of fixed income at BNP Paribas .

He then went on working in the hedge fund industry, at Asymmetry Asset Management and Excelsia Capital . During this experience he discovered the world of crypto and stablecoin, and that was the push that led him to launch BVNK. BVNK builds enterprise-grade payments infrastructure for stablecoins, and is one of the biggest payments providers in this industry, with more than 300 employees and over $12 billion in transactions managed.

With him, we will be talking about his experience coming from South Africa to London and San Francisco, his take on the fintech market, and most importantly the present and future for stablecoin.

Coming back to us, I was reading an interesting report this week, the “Status of Crypto Q2 2025” from Coinbase. The popular exchange shares a regular report where they interview F500 executives talking about their crypto strategies, stablecoin technologies and future trends in payments. Here my main takeaways:

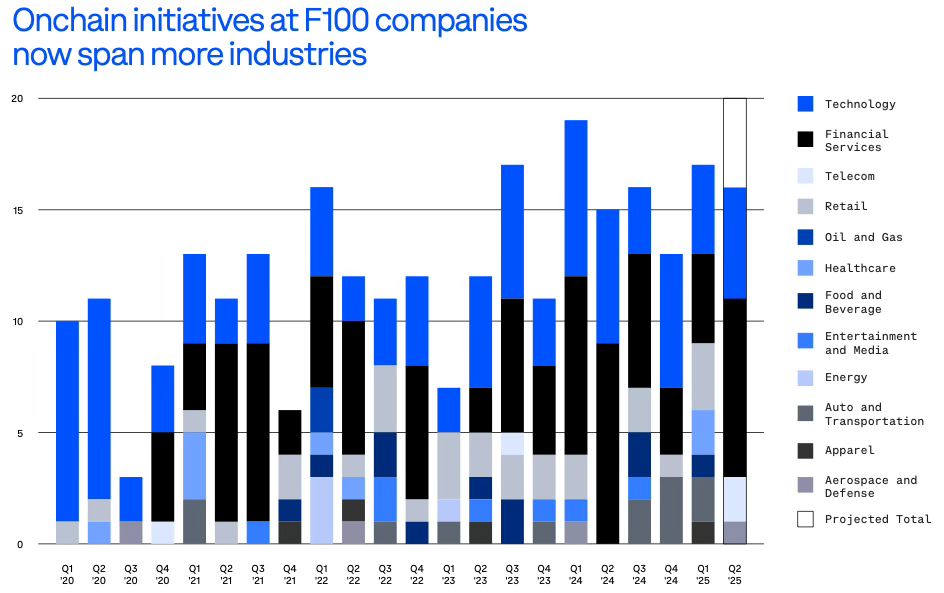

Sixty percent of respondents reported their companies are currently engaged in onchain initiatives, while 47% indicated increased investment in this technology. The average number of onchain projects per company has grown significantly year-on-year, rising from 5.8 to 9.7 projects—a 67% increase.

Among Fortune 500 firms, the focus of onchain initiatives is expanding. The most common projects include payments and settlement (47%), supply chain management (44%), and blockchain infrastructure (40%). The fastest-growing areas year-on-year are cross-border transfers, corporate treasury, and crypto product development, while emerging use cases include identity and data management.

In Q1 2025 alone, 17 unique onchain initiatives were announced by Fortune 100 companies, matching the second-highest quarterly record. From Q3 2024 to Q1 2025, 46 such initiatives were recorded, with growing participation beyond finance and tech into sectors like automotive, retail, food and beverage, and healthcare.

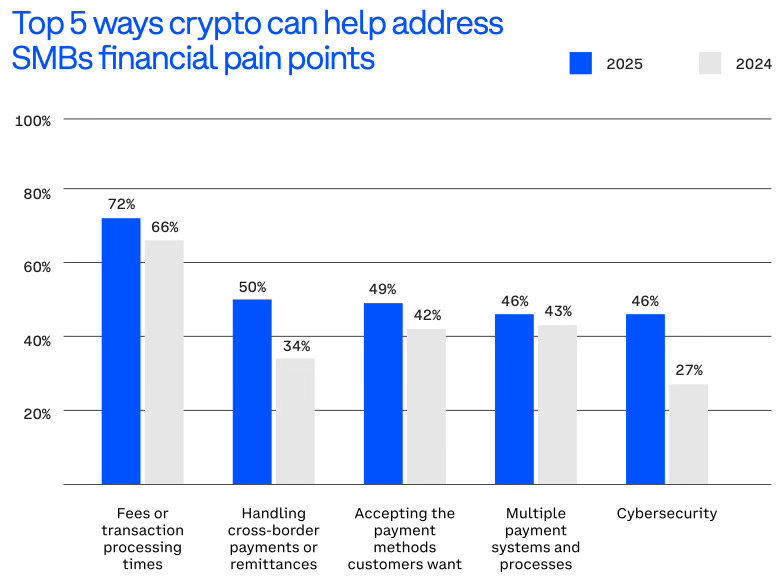

In 2025, small and medium-sized businesses have significantly increased their engagement with crypto, marking what Coinbase calls a “triple double” year. Compared to 2024, the percentage of SMBs using cryptocurrencies has doubled from 17% to 34%, stablecoin usage has grown from 8% to 18%, and the share of those having sent or received payments in crypto has also doubled from 16% to 32%.

Interest in crypto has surged, with 84% of SMBs now expressing a willingness to use it in their operations, up from 65% the year prior. This growth is driven by the belief that crypto can address key financial pain points. In 2025, 82% of SMBs said crypto could help solve at least one of their financial challenges, compared to 68% in 2024. Moreover, 57% now believe that adopting crypto can save their business money—an increase from 42% the year before.

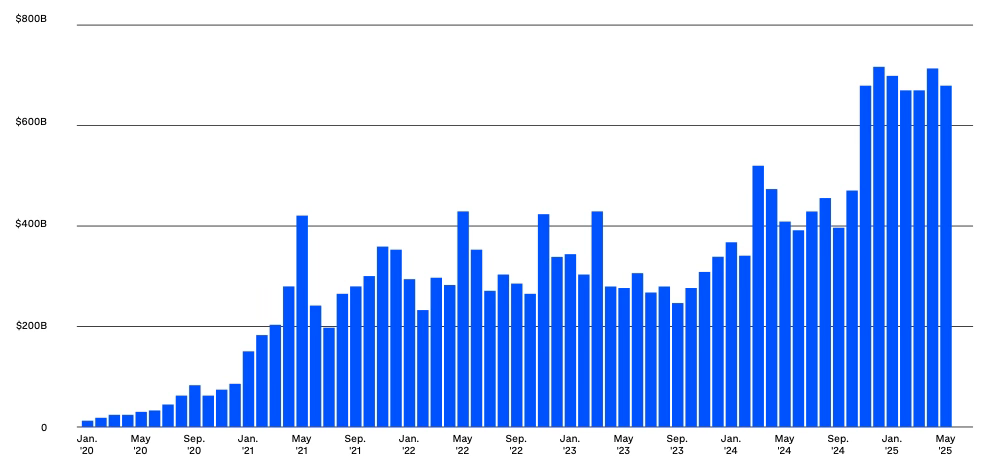

Stablecoin adoption is accelerating at an unprecedented pace. In the past year alone, adjusted transfer volumes hit record highs, with December 2024 reaching $719 billion and April 2025 close behind at $717.1 billion. These figures reflect genuine activity, excluding artificial volume from internal smart contracts, MEV bots, and intra-exchange flows.

Since 2019, annual stablecoin settlement volumes have not only surpassed those of the global remittance market and PayPal but are now approaching Visa’s scale. Stablecoin ownership has also surged, with over 160 million holders as of May 2025—more than the combined user base of the top four U.S. mobile banking apps.

As of May 2025, stablecoins represent just under 10% of all U.S. currency in circulation, with a total supply reaching $247 billion, marking a 54% year-over-year increase. Notably, USDC reached a record $62 billion market cap in April 2025. Together, Circle and Tether.io now hold more U.S. Treasury bills than some major sovereign nations, underlining the growing systemic relevance of stablecoins in the global financial ecosystem.

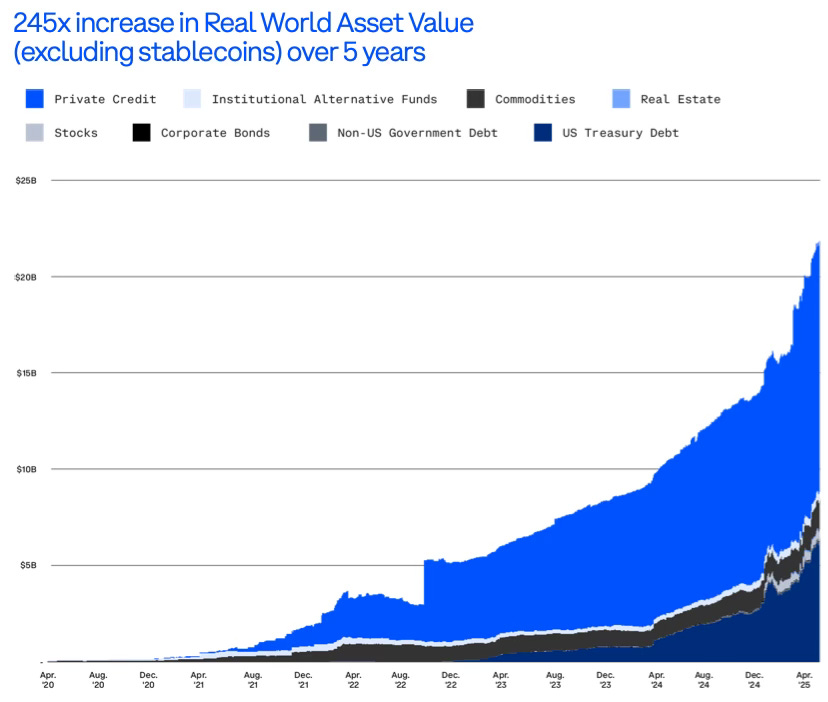

The tokenization of real-world assets (RWAs) has experienced explosive growth, rising from $85 million in April 2020 to over $21 billion by April 2025—a 245-fold increase. This market is currently dominated by private credit, which accounts for 61% of all tokenized assets, followed by tokenized treasuries at 30%, commodities at 7%, and institutional funds at 2%.

Tokenized RWAs are increasingly being adopted across diverse business applications. In cash management, tokenized treasuries provide faster settlement, programmability, and 24/7 liquidity, offering an efficient alternative to traditional idle cash allocation methods. In invoice financing, tokenized receivables enable SMBs to unlock global liquidity, automate payments, and reduce administrative burdens. In private credit, tokenization lowers entry barriers, expands investor access, and enables secondary market trading, improving both pricing and liquidity.

Private credit alone has grown from near zero to $12 billion, with Figure leading the sector. Tokenized U.S. Treasuries have also expanded rapidly—from under $500 million in late 2022 to more than $6 billion by April 2025. Platforms like BUIDL and BENJI now hold over half the market, signaling accelerating institutional adoption and capital inflows.

Anyway we saw a lot of interesting news this week. Stablecoins still dominate the news, with Coinbase launching their stablecoin payment service for eCommerces and Revolut reported working on their proprietary stablecoin, while J.P. Morgan already launched its JPMD token project. X is going to offer investments and trading as part of its super app vision, while Coinbase is looking for SEC approval in the US for onchain stocks trading to provide 24/7 trading hours and Klarna launched their mobile service as part of global expansion. In the VC industry, we saw Felicis launching a $900 million fund and Par Equity merging with Praetura Ventures to launch a $670 million fund. In the italian market, Jet HR closed a crazy $25 million round. And finally, we saw many interesting rounds from fintech startups like Aspora, NaroIQ, Ramp, Payabli, Grifin, Tensec, Juniper Square and many others.

But let's take a closer look at the main news of the last seven days.

Closed deals

Aspora raises $50 million to expand banking for the Indian diaspora

Ramp is reported hitting $16 billion valuation after a $200 million fundraising

XFOLIO AI raises $2 million Seed round to disrupt enterprise wealthTech in MENA and Europe

Philippine fintech Salmon Group Ltd raises $88 million to expand inclusive lending across Southeast Asia

Juniper Square secures $130 million Series D at $1.1 billion valuation to launch JunieAI for private markets

Lumion (Formerly Mia Share) raises $10.7 million Seed round to modernize trade school operations across the U.S.

NaroIQ raises $6.5 million to democratize ETF infrastructure for fund providers

Payabli raises $28 million Series B to accelerate AI-powered payments infrastructure for software platforms

Grifin raises $11 million Series A to simplify investing for everyday shoppers and empower female investors

Tensec raises $12 million to build Stripe-like infrastructure for global B2B trade

Polar secures €8.6 million to redefine software monetization for the next generation of developers

Multiplier raises $27.5 million to build an AI-driven challenger to the big four

Colossus Digital raises €1 million from SBI Ven Capital Pte Ltd to scale institutional crypto infrastructure

Project 11 raises $6 million to safeguard Bitcoin from quantum threats

Mahaveer Finance India Limited raises ₹200Cr ($23 million) to expand credit access for underserved entrepreneurs

Juniper Square secures $130 million Series D at $1.1 billion valuation to launch JunieAI for private markets

Insights on the VC industry

Felicis launches $900 million fund to back the next generation of AI-first startups

Par Equity and Praetura Ventures merge to Launch £670M PXN Group, targeting regional UK innovation

News on the market

LemFi acquires Pillar to boost immigrant credit access in the UK

Coinbase and Gemini near EU licensing amid MiCAr regulatory debate

TBC Georgia partners with Turkish Airlines and Visa to launch first airline Co-branded bank card in Georgia

Solaris SE fined €500K by BaFin, adding to regulatory pressure in Germany’s fintech sector

Alipay brings QR code payments into AR glasses with Rokid Corporation Ltd

Pix Automático launches recurring payments in Brazil starting today

Guavapay and YouLend join forces to deliver embedded financing for UK SMEs

Ripple eyes historic milestone with $30 billion valuation amid IPO speculation

Revolut to launch AI financial assistant as it targets smarter money management at scale

J.P. Morgan launches JPMD token pilot on Coinbase to pioneer deposit token adoption

Klarna expands into U.S. mobile market as it pursues AI-driven super app vision

Coinbase eyes SEC approval to launch blockchain-based stock trading in the U.S.

Razorpay acquires majority stake in POP with $30 million investment, expands into consumer UPI and loyalty

Coinbase launches Stablecoin payment service to global eCommerce

Fabrick completes the acquisition of finAPI to accelerate its European open finance strategy

Revolut is actively looking at the launch of a proprietary stablecoin

Coinbase secures MiCA license and selects Luxembourg as new EU Hub

A special look in the Italian market

JetHR raised a staggering $25 million round

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

European women in Tech - Amsterdam | 25-26.06.2025 (link to event)

Italian Tech Week - Turin | 1-3.10.2025 (link to event)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #85