Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

The latest episode of Builders has been released this week. In this episode, I sit down with Meifan Shi (史美帆), managing partner at Waterpoint Lane , a venture capital and growth equity firm that specializes in unlocking transformative opportunities in the agrifoodtech sector.

Meifan has 20+ years in technology and finance, she built, scaled, and exited high-growth companies, driving EBITDA growth, enterprise value, and long-term scalability across Fortune 500 firms and market-defining startups. She also co-founded the private equity business at AWS, growing an $800B+ AUM client portfolio and generating $50M+ in revenue within 18 months. Here a small clip from the episode:

With her, we will talk about the experience of launching the first fund coming from a syndicate, the agrifoodtech sector and the challenges they face, but also how to bring value to startups by collaborating with large corporations.

You can find the link to the full episode here on YouTube, or you can listen to it here on Spotify and here on Apple Podcast.

Coming back to us, I’ve been reading a very interesting report this week, the “State of Italian VC - Tracing evolution and market opportunities” from P101. The report is a comprehensive analysis on the venture capital (VC) landscape in Italy, providing an in-depth look at the investment patterns, trends and growth dynamics within the Italian VC sector, tracing its developments over the last decade, with a focus on 2024. Here my main takeaways:

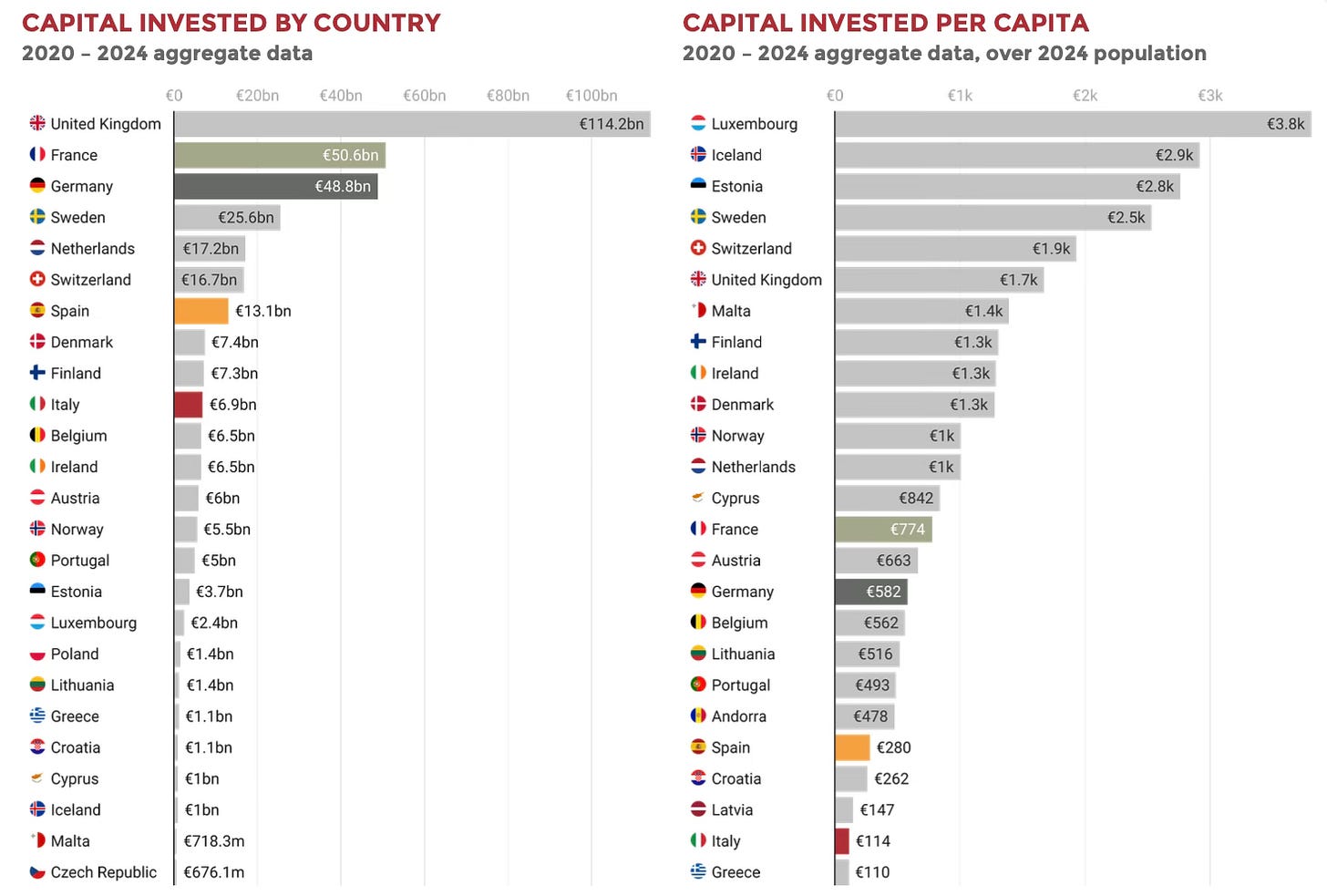

Between 2020 and 2024, Europe attracted €273.4 billion in venture capital investments, with the United Kingdom securing €114.2 billion, representing 41.8% of the total. France followed with €50.6 billion, while Germany attracted €48.8 billion, giving these three markets a combined share of nearly 78% of all European VC capital.

Northern and Western Europe also played a key role, with Sweden securing €25.6 billion, the Netherlands €17.2 billion, and Switzerland €16.7 billion, all reinforcing their status as important innovation hubs. Denmark maintained stable activity with €7.4 billion, closely followed by Finland with €7.3 billion and Belgium with €6.5 billion.

In Southern Europe, Spain led the region with €13.1 billion, supported by its balanced ecosystem, followed by Italy at €6.9 billion. Austria attracted €6 billion and Portugal €5 billion, positioning themselves as mid-tier markets. Eastern and Southern Europe showed more fragmented progress.

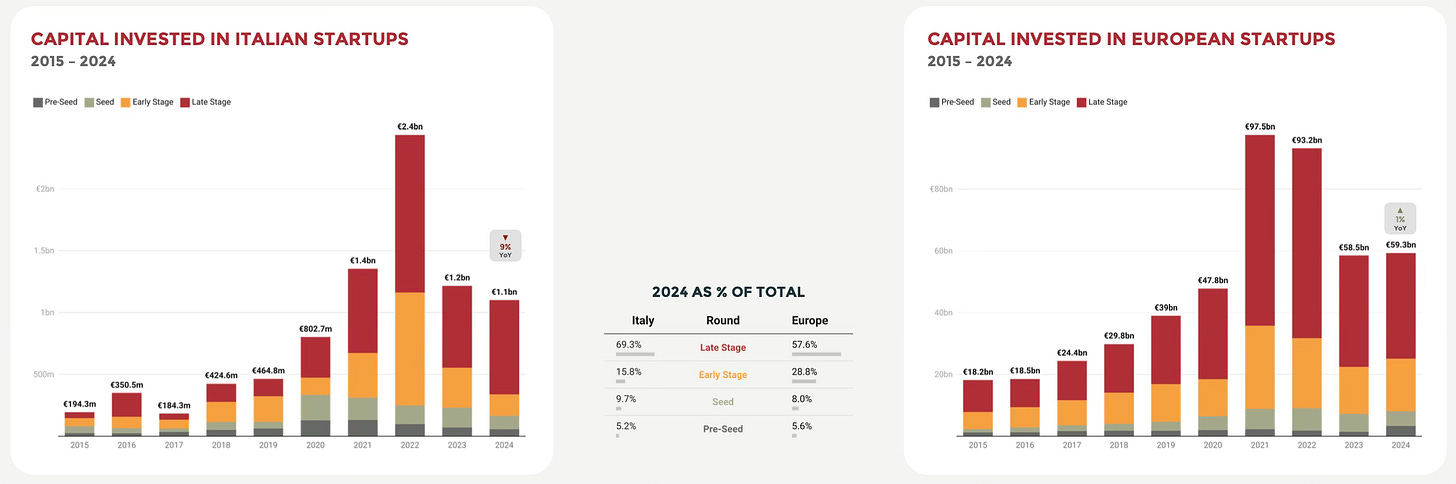

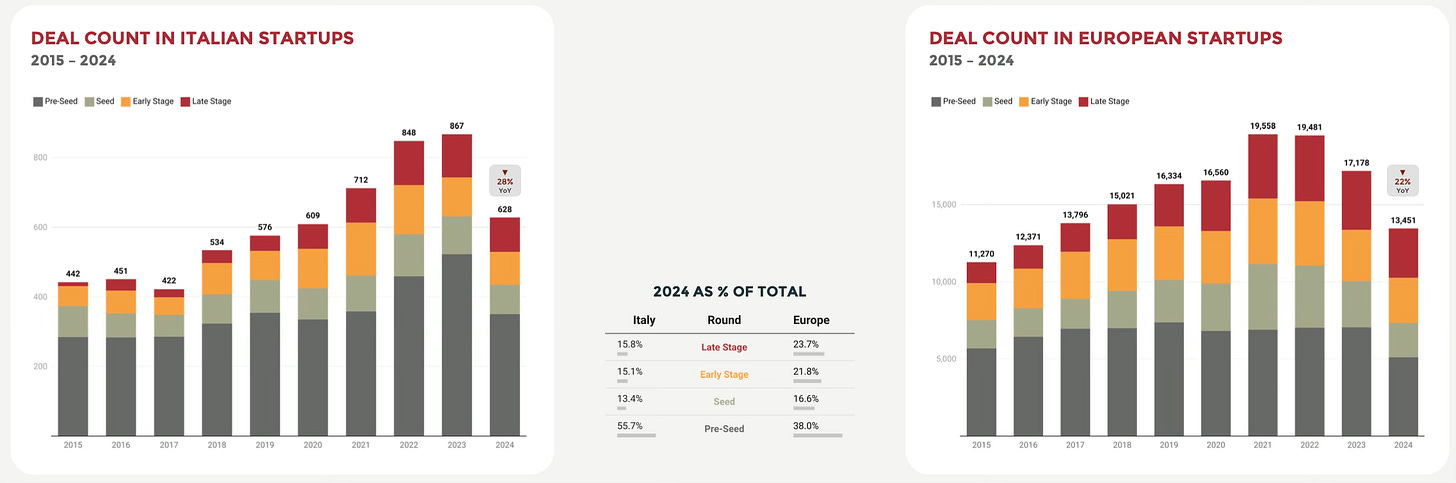

In 2024, Italy’s venture capital investments fell 9.5% year-on-year to €1.1 billion, down from €1.2 billion in 2023 and 54.8% below the record €2.4 billion reached in 2022. Despite this decline, Late Stage funding grew 15.2% to €763 million, representing 69.3% of total investments, although it remains 40.2% lower than in 2022.

Between 2015 and 2024, Italy’s VC investments grew 467%, rising from €194 million to the 2022 peak, while European investments increased 226% over the same period, from €18.2 billion to €93.2 billion. In 2024, Italy’s early-stage investments continued to decline sharply, with Seed funding falling 33.5% to €107 million, Early Stage down 46.1% to €174 million, and Pre-Seed decreasing 18.6% to €57 million, highlighting ongoing structural challenges in supporting startups at the earliest stages.

In 2024, Italy recorded 628 venture capital deals, marking a 28% drop from the 867 deals closed in 2023 and falling below 2021 levels. This decline outpaced Europe’s 22% contraction, where total deals dropped from 17,178 in 2023 to 13,451 in 2024. Despite this, Italy’s share of Europe’s total deal volume remained stable at 4.7%.

Pre-Seed deals accounted for 56% of Italy’s total, with 350 transactions, though this segment contracted 33% year-on-year, closely mirroring Europe’s 28% decline to 5,104 Pre-Seed deals. In Italy, Seed deals fell 24% to 84, Early Stage transactions declined 14% to 95, and Late Stage deals dropped 20% to 99.

Between 2020 and 2024, Italy secured €6.9 billion in venture capital investments, ranking 10th in Europe. While ahead of Belgium with €6.5 billion and Austria with €6 billion, Italy remained well below Spain’s €13.1 billion and significantly behind leading markets such as the United Kingdom with €114.2 billion, France with €50.6 billion, and Germany with €48.8 billion.

Despite being Europe’s fourth-largest economy by GDP, Italy’s VC funding remains structurally low, highlighting ongoing difficulties in scaling innovation and attracting growth-stage capital. On a per capita basis, Italy ranks only 24th in Europe, with €114 invested per person, compared to Spain at €280, Portugal at €493, Austria at €663, Estonia at €2,800, and Luxembourg at €3,800. Although the funding gap remains wide, Italy’s continued growth points to the potential for further alignment with Europe’s leading innovation ecosystems.

Anyway we saw some very interesting news in the market this week. Klarna teams up with Nexi Group, while Affirm extends its deal with Shopify. Marqeta acquires TransactPay, and Prosus Group acquires Just Eat Takeaway.com for $4.1 billion. Checkout.com grew 80% in the states and opened a San Francisco office, while the crypto world was shocked by the Bybit $1.4 billion heist. In the VC market, Afore Capital closes a $185 million fund, Cherryrock Capital lands $172 million, but also Fund F and Perplexity with new funds. In the Italian market, we saw BANCOMAT acquiring FlowPay and Mopso closing a $1 million seed round. Finally, some very interesting funding rounds from fintech startups like Taktile, Unique, Adfin, CredCore, Flow48, Capim, Gozem - Africa's Super App, amnis, and many others.

But let's take a closer look at the main news of the last seven days.

Closed deals

CredCore raises a $16 million round to innovate AI-driven credit investing and management

Adfin raises $12.5 million in total seed funding to help businesses get paid

Shop Circle closes a $60 million series B to drive the future of AI-powered B2B software

Healthcare payment provider Waystar announces $800 million public offering

Turkish fintech Flow48 secures $69 million to expand into Saudi Arabia

WalletConnect Foundation secures $10 million in oversubscribed token sales

Zurich based amnis secures a CHF10 million funding round led by Swisscom Ventures

Barcelona based fintech Flanks secures a $14 million round

Global fintech ClearScore secures a $30 million debt facility from HSBC

Raise secures $63 million to build a blockchain backed gift card program

Brazilian BNPL Capim lands a $26.7 million series A

Payment fintech Meridian secures a $15 million round led by EQT Ventures

Vayu secures a $7 million seed funding round

African fintech Gozem - Africa's Super App raises $30 million to expand car financing and digital banking in francophone Africa

Taktile secures a $54 million series B to help fintechs automate decision making

USDe stable coin developer Ethena Labs raises $100 million

Swiss based fintech Unique raises $30 million for its AI finance platform

Prague based BitDCA secures a $7.6 million round to bring Bitcoin to the masses

BBVA support Spanish fintech MytripleA with a $30 million financing deal

Insights on the VC industry

Afore Capital raises a new $185 million fund to help pre-seed founders get new ideas

Cherryrock Capital closes a new $172 million fund to invest in diverse founders

Fund F closes a $28 million oversubscribed fund to back gender-diverse founder teams

AI developer Perplexity launches a $50 million pre-seed fund

Khosla Ventures is looking to raise $3.5 billion in new funds

Thoma Bravo closes a $1.8 billion fund to acquire European software companies

News on the market

Hackers steal $1.4 billion from exchange Bybit in the biggest ever crypto heist

Dutch fund Prosus Group acquires Just Eat Takeaway.com for $4.1 billion

Monument is in talks to raise £200 million ahead of the IPO

Walmart backed PhonePe prepares for Indian stock market debuts

Klarna teams up with Nexi Group to boost merchant growth

Affirm and Shopify sign a deal to take their partnership global, with the first one that will continue be exclusive provider of Shop Pay Installments in US

Embat acquires fintech startup Necto to boost bank API connectivity and instant payments

Monument partners with Firenze to expand Lombard loans with a $160 million credit facility

Checkout.com grows 80% in the US and opens an office in San Francisco

A special look in the Italian market

Italian fintech Mopso closes a 1 Million round for its AML platform

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

4YFN - MWC - Barcelona, Spain | 03-06.03.2025 (Link to the event)

Hello Tomorrow global summit - Paris, France | 13-14.03.2025 (Link to the event)

Start summit - St. Gallen, Switzerland | 20-21.03.2025 (Link to the event)

Nordic startup challenge - Hamburg, Germany | 24-26.03.2025 (Link to the event)

Tech.eu Summit - London, UK | 25-26.03.2025 (Link to the event)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Tutornow - Edtech that provides an online tutoring platform for students with learning disorders. Raising $500k to $1M.

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #69