Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

The latest episode of the Builders podcast has been released this week. In this episode, I sit down with Cam Rail, CFA and Joseph Pizzolato, founders of Defiant VC. Here a short clip from the full interview:

Defiant is a venture capital fund based in London and Lisbon. They focus on B2B SaaS and Fintech and invest in Seed ($1-3m) and Series A ($2-10m) across Europe and occasionally the US. Mostly like technical products, those with complexity, moats and barriers to entry, where we have deep expertise and an ability to add value.

Cam is the product mind of the VC. With past experience as a derivatives trader and founder, he went on working as product lead with Creativemass and Tropicana Sunrise. Joseph has a huge experience as an investor in Europe, coming from a strong VC and finance background, he invested over time on some big names like TravelPerk, Wise and Marqeta.

With them we will explore the high and low of launching a new VC fund, but also the future of the fintech market, the importance of a highly transversal background and what it takes to build a billion dollar startup in Europe.

You can find the full video here on Youtube, and the audio here on Spotify and here on Apple Podcast.

Coming back to us, I’ve been reading some very interesting data this week on the VC investments trend in January 2025 provided by Trustventure. They have a very detailed investment tracker, almost live and up to date, that can provide data on VC investment in Europe. Here my main takeaways:

January 2025 witnessed a slight 1% decline in venture capital investment volume, alongside a major funding milestone for the newly founded biotech startup Verdiva Bio , which secured an impressive $411 million.

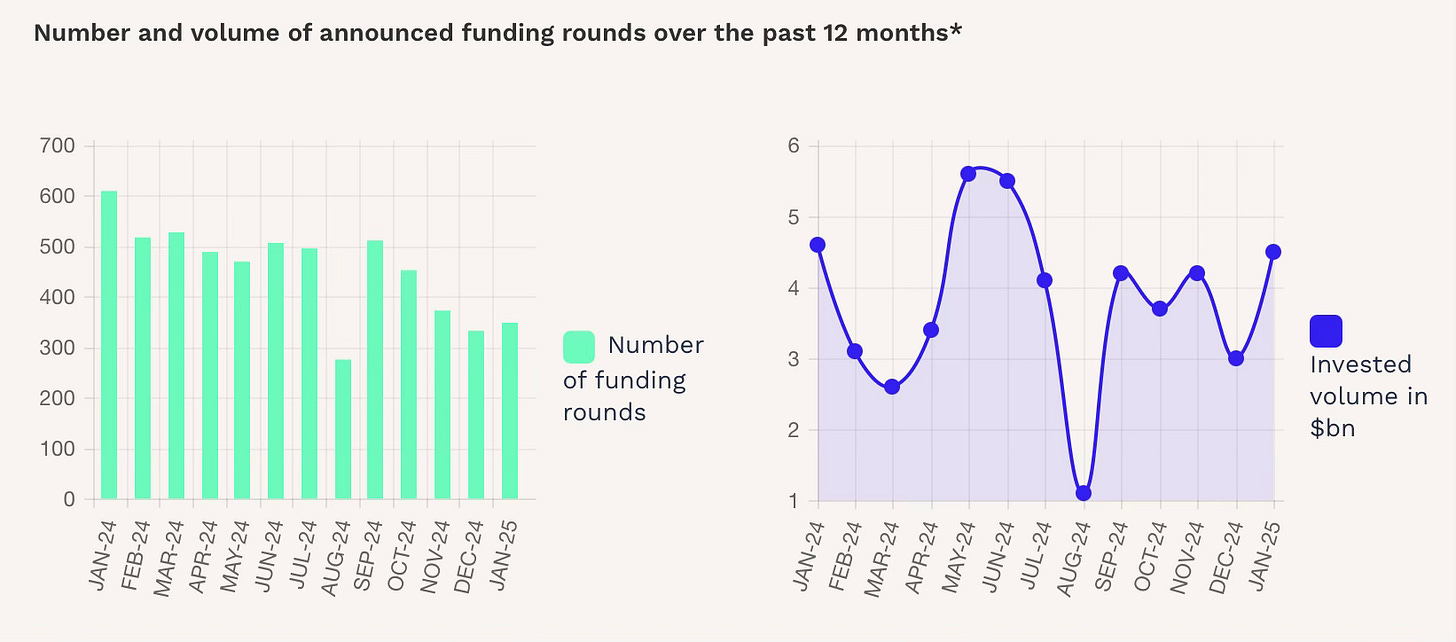

Across Europe, 349 VC deals were recorded, totaling $4.5 billion in investments. Despite a sharp 43% drop in deal count compared to January 2024, when over 600 rounds were announced, the total investment volume remained steady.

The data reveals a year marked by volatility. August 2024 recorded the lowest number of funding rounds, with approximately 300, while June 2024 peaked in invested volume, surpassing $5.5 billion. In contrast, September 2024 saw a significant dip in volume, barely exceeding $1 billion. Despite fluctuations throughout the year, January 2025 closed with a rebound in invested capital, nearing $4.5 billion, reflecting sustained confidence in high-potential ventures despite fewer deals.

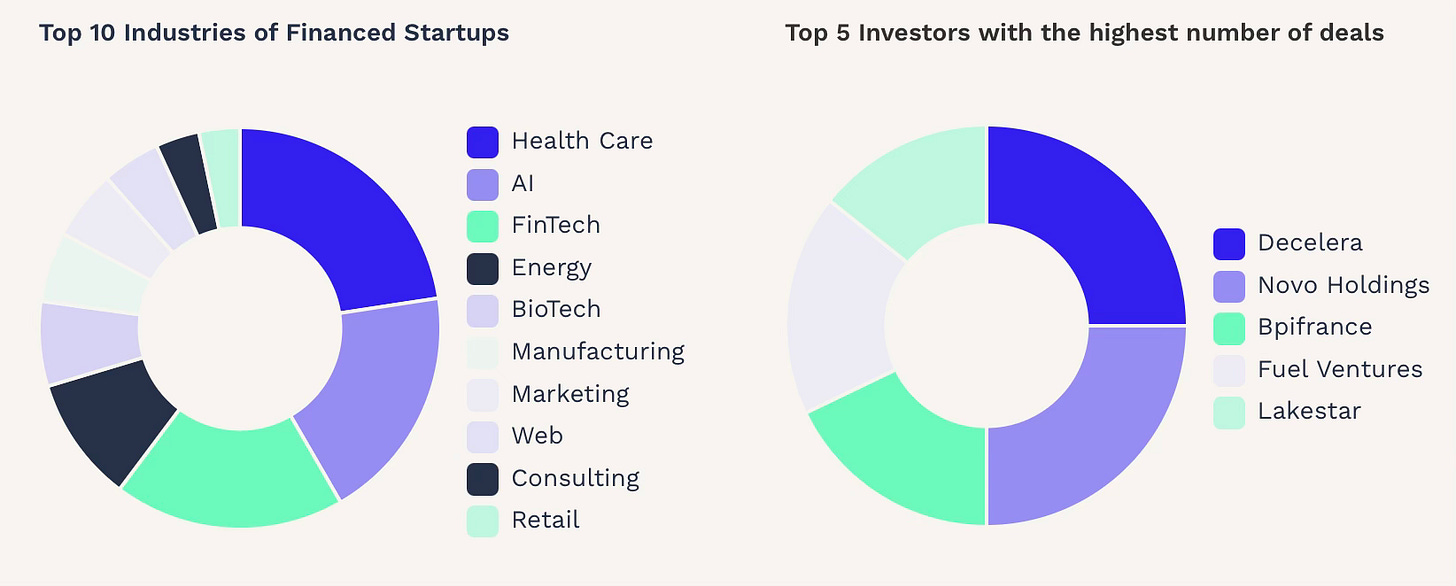

Health care startups dominated the market with 96 investments, solidifying their lead within the broader industry. AI startups followed closely with 81 investments, underscoring the sector's growing appeal, while FinTech startups secured the third spot with 79 investments, reflecting continued investor interest in financial innovation.

On the investor front, Decelera and Novo Holdings emerged as the most active venture capital firms, each completing 7 deals. They led the pack ahead of Bpifrance and Fuel Ventures 🚀 , which both closed 5 deals, while Lakestar rounded out the top five with 4 investments.

In January, Verdiva Bio secured the largest funding round with a $411 million Series A investment. The London-based biotech startup, founded in 2024, is developing cutting-edge treatments for obesity and cardiometabolic diseases.

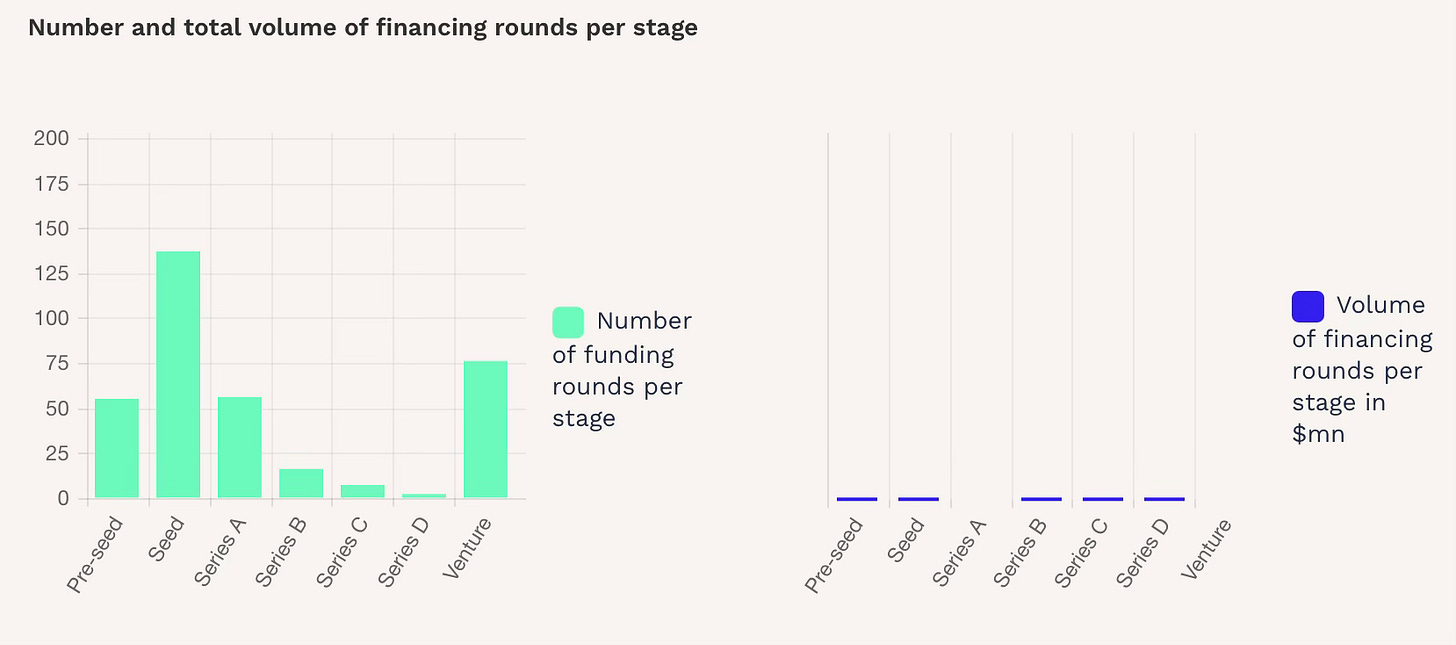

Seed rounds dominated in terms of deal count, representing approximately 39% of total rounds with over 130 investments. However, Series A rounds led in total investment volume, raising $1.6 billion across 56 deals, driven by Verdiva Bio’s landmark funding.

Xcalibur Smart Mapping closed the largest Seed round, raising $41.2 million. Founded in Madrid in 2021, Xcalibur provides natural resource mapping services for the airborne and geophysics industries, underscoring investor interest in deep-tech solutions.

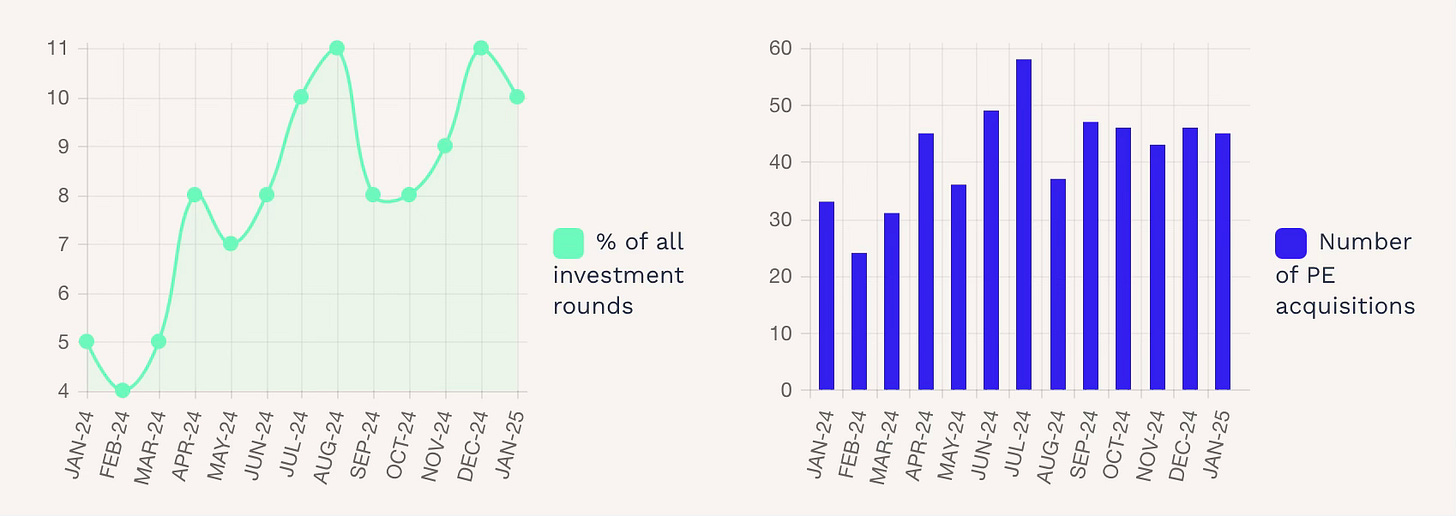

Private Equity (PE) activity continued its upward trend, with acquisitions in January rising by 36% year-over-year to reach 45 deals, compared to 33 in January 2024. Italy led the market with 10 acquisitions, while the manufacturing sector emerged as the top target for PE investors, recording 11 acquisitions.

The share of PE investments within the total 394 rounds (VC + PE) in January doubled from the previous year, reaching 10% of all deals.

The largest disclosed acquisition was Brookfield ’s $1.7 billion purchase of Chemelex , a Barcelona-based chemicals provider specializing in laboratory disease detection. This deal highlights PE’s continued focus on high-growth industrial and healthcare segments.

Anyway we saw some very interesting news in the market this week. Klarna is aiming to go public in April, while Gemini is planning for an IPO later on this year. Plaid is working with Goldman Sachs to let employees and early stage investors sell their shares, and Stripe is actually doing the same with his employees at a $85 billion valuation. Finally, Coinbase is looking to come back in the Indian market. In the VC industry, Founders Fund is looking to raise a $3 billion growth fund, while we saw some new funds from Nina Capital and Hamilton Lane. In the Italian market, TeamSystem bought Muscope Cybersecurity, a good first exit for Primo Capital in 2025, while Satispay is looking for potential M&A deals. Finally, some very interesting funding rounds from fintech startups like Tabby, Raenest, Fifteenth, Mundi, Sardine, Zeta, RasMal | راس مال, Lynx, Affinity Africa and many others.

But let's take a closer look at the main news of the last seven days.

Closed deals

INXY Payments secures a $3 million round to facilitate the integration of crypto payments into traditional business operations

Miami based fintech Superlogic raises $13.7 million to help people using reward points to pay for experiences

Rho Labs secures a $4 million seed round to accelerate the growth of crypto native rates exchange Rho Protocol

Irish fintech ZeroRisk.io raises a $4 million round led by Elkstone

Lynx closes an oversubscribed $27 million series A to reshape payments in the healthcare system

Banking software provider Zeta secures a $50 million round at $2 billion total valuation

Sardine announces a $70 million series C round!

Indian fintech Rupeeflo - NRI Banking & Wealth Platform raises a $1 million pre-seed round

Ghanaian fintech Affinity Africa secures $8 million to scale digital banking in a mobile money-driven market

Fintech veteran Lukas Zörner launches Integral with a $6.3 million round

Tabby doubles its valuation to $3.3B with a $160M Series E as it expands beyond BNPL and prepares for IPO

African fintech Raenest secures a $11 million funding round led by QED Investors

Zurich based ETFbook secures $4 million for its ETF focused data platform

Madrid based LIBEEN Smart Housing raises $25 million to help Gen Z buy a home

Turkish fintech Mundi secures $2.5 million for its capital markets platform expansion

Investors communication platform Proxymity secures a $26 million facility from a pool of major banks

Tax solution Fifteenth raises $8.25. million in a seed funding round

AI-powered wealth management startup Era Finance raises a $6.2 million seed round

UK fintech Revving secures a £107M led by asset manager DWS Group to address delayed payments

Saudi fintech RasMal | راس مال secures a $4.8 million pre-series A

Citi and PayPal join the $18.5 million round of the Singapore-based fintech Finmo

Insights on the VC industry

Hamilton Lane closes a first Venture Access Fund at over $615 million

Founders Fund nears close on $3B growth fund, doubling down on late-stage investments

Nina Capital closes a first $50 million fund to invest in early-stage health tech startups

Ulu Ventures raises a $208 million fund to invest on diversity

News on the market

Klarna targets an IPO in the US in April, while its founder start talking about their crypto ambitions

Crypto exchange Gemini is in talks to pursue an IPO in 2025

Stripe competitor Rapyd faces a valuation cut while looking to raise $300 million

Plaid is working with Goldman Sachs to let early stage investors and employees sell between $300 and $400 million of shares

Klarna partners with J.P. Morgan to expand merchant payments offering

Bitpanda secures Financial Conduct Authority approval to operate in the UK!

Stripe considers employee shareholder sale at $85B+ valuation

A special look in the Italian market

TeamSystem buys Muscope Cybersecurity and gives Primo Capital the first exit of 2025

Satispay it’s not looking for a quick IPO but wants to grow through M&A

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

0100 DACH - Wien (Austria) | 18-20.02.2025 (Link to the event)

Tech Arena - Stockholm (Sweden) | 20-21.02.2025 (Link to the event)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Tutornow - Edtech that provides an online tutoring platform for students with learning disorders. Raising $500k to $1M.

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #67