Weekly update #107

The latest news in the fintech and VC ecosystem

Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

Builders is back with Season 3! In the last episode, I sat down with Tomás Campos , founder of Spinwheel. You can find the full episode here on YouTube, or here on Spotify and here on Apple Podcast. Take a look at a short clip from the episode:

Tomás Campos is the co-founder and CEO of Spinwheel, the agentic AI-powered credit data and payments platform that is revolutionizing the consumer credit ecosystem. Spinwheel services more than 15 million users and 165 million accounts, facilitating $1.5 trillion in connected debt across its network. A three-time founder, Tomás is a noteworthy entrepreneur, executive, inventor, and operator across payments, data, retail, consumer, and Saas industries.

Prior to Spinwheel, Tomás founded and sold his previous company to Westfield Inc. where he then served as the SVP of product. He also grew the digital payments division of Blackhawk Network Inc. to a $1.5 billion business and independent reporting segment as the global general manager.

With him, we talked about the whole experience of being a founder, that might not be for you, the differences between first time and second time founders, the credit market globally and how to raise funds in this environment.

Coming back to us, I’ve been reading a very interesting study this week, the “Race for compute - 2025 Globalscape” from Accel . The report is an extensive study done by the well known VC fund on the impact of AI in the startup ecosystem and on the IT market overall. Here my main takeaways:

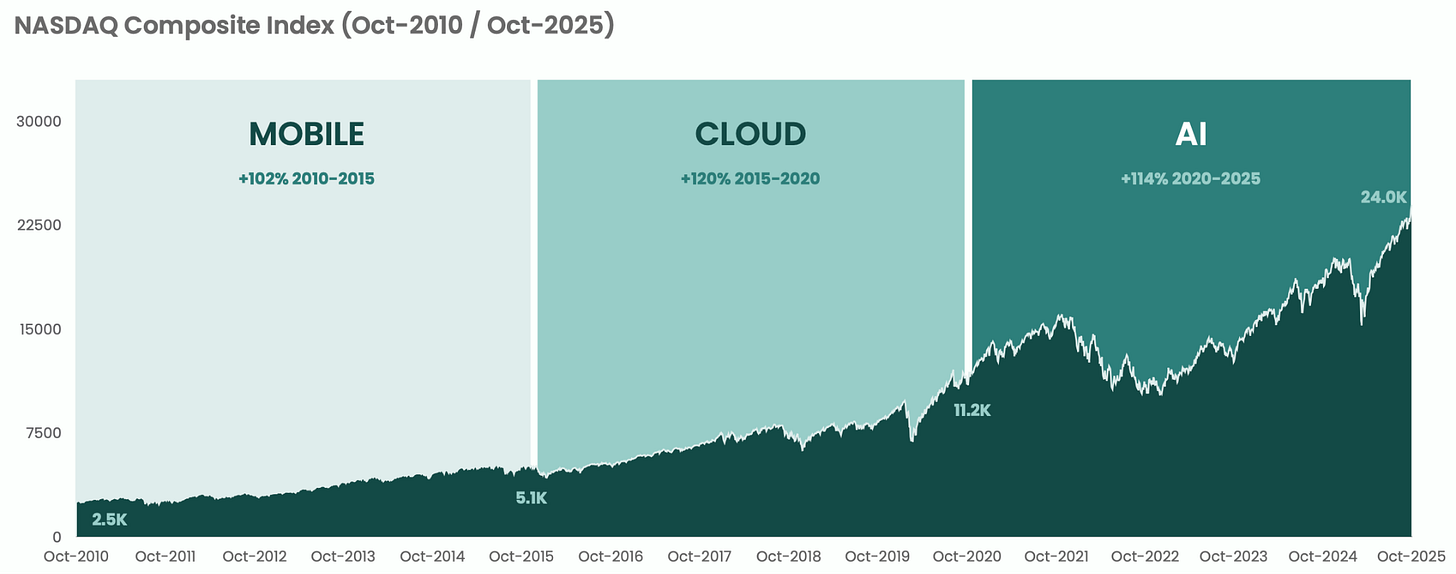

Starting from the historical data, the NASDAQ Composite climbed from roughly 2,500 in October 2010 to around 24,000 by October 2025, capturing three distinct growth phases: mobile (2010-15, +102 %), cloud (2015-20, +120 %) and recently AI (2020-25, +114 %). During the mobile era the index doubled, then more than doubled again through the cloud surge, and spent the last five years ascending into the AI-driven market environment. The marked milestones at ~5,100 in 2015 and ~11,200 in 2020 reflect these transitions.

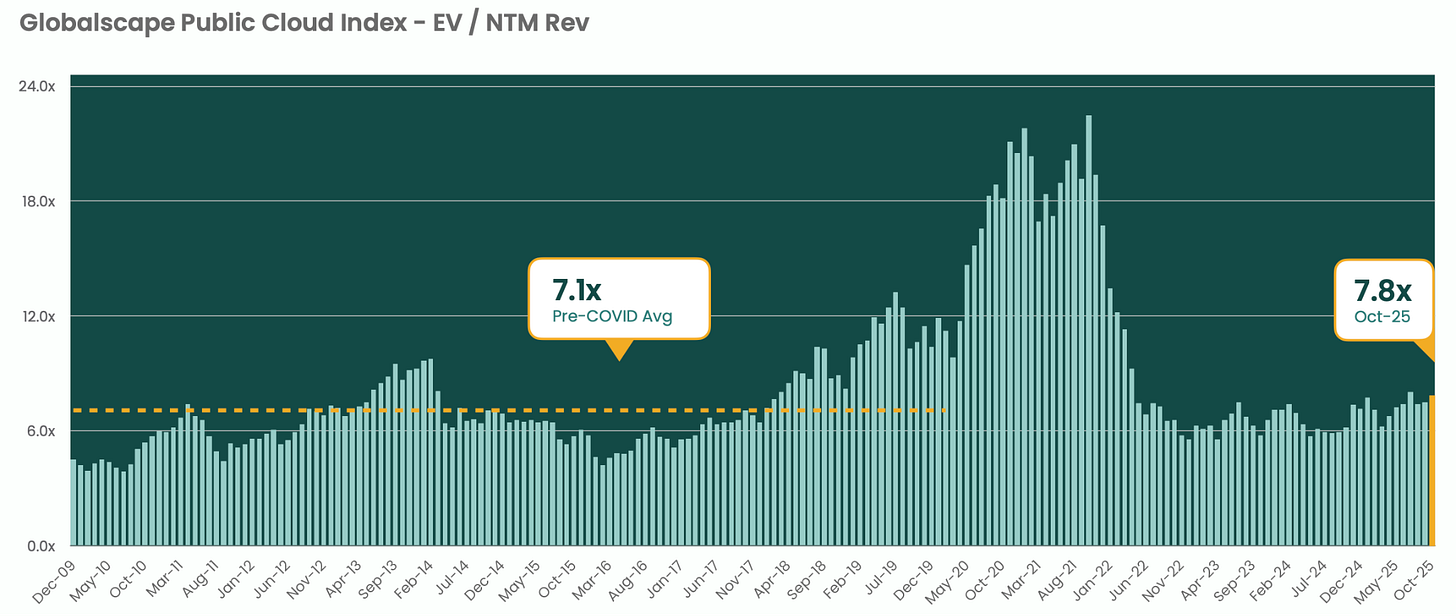

Multiples wise, we are finally back to the pre-covid era. The GlobalScape Public Cloud Index — specifically its forward-looking EV/NTM revenue multiple — tracking from around 5× pre-COVID to a peak well above 15× during the 2020-21 cloud-rush and settling at approximately 7.8× by October 2025. The pre-COVID average is roughly 7.1×, while the reversion to ~7.8× signals a more disciplined investment environment as AI transitions from hype to execution.

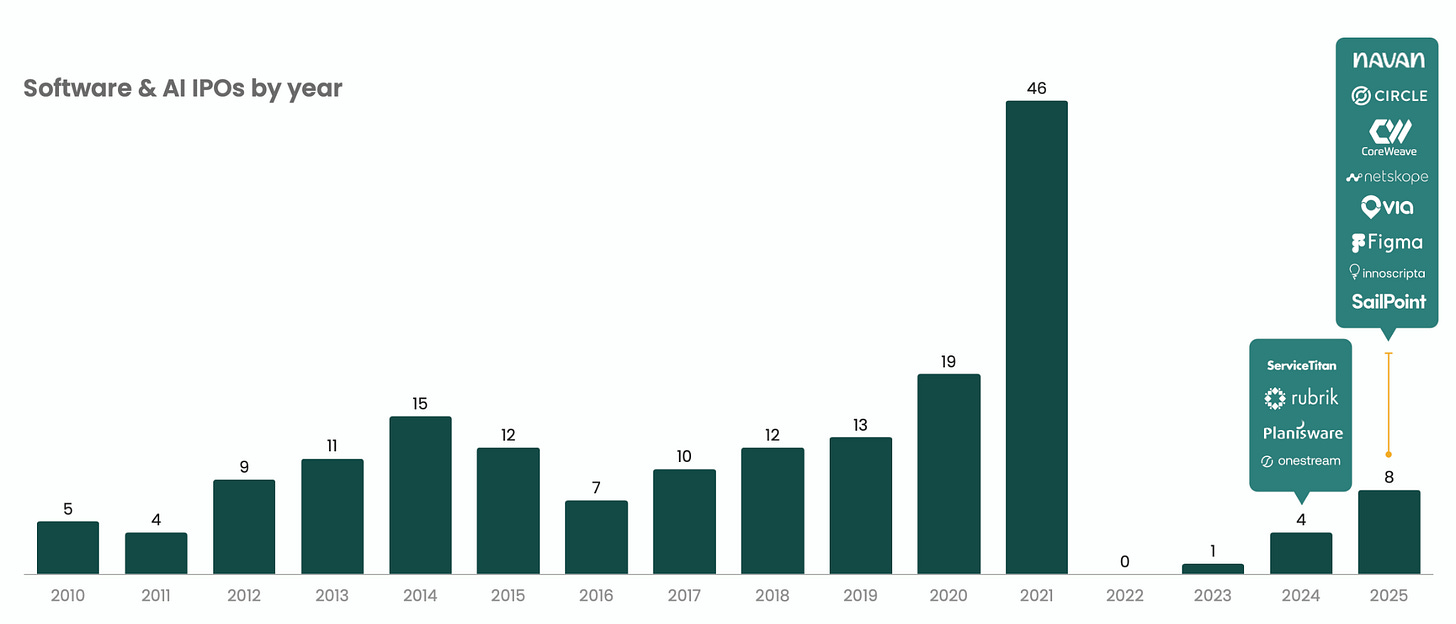

Taking in consideration the IPO market, the annual number of software and AI-related IPOs, showed a notable surge to 46 listings in 2021, followed by a steep drop to virtually none in 2022, then a gradual rebound with 4 in 2024 and 8 expected in 2025. This dramatic spike in 2021 aligns with record global IPO flows—$594 billion raised that year—while the subsequent fall reflects tougher capital market conditions. In the context of the AI market, the 2021 peak signals excess investor optimism around the tech wave.

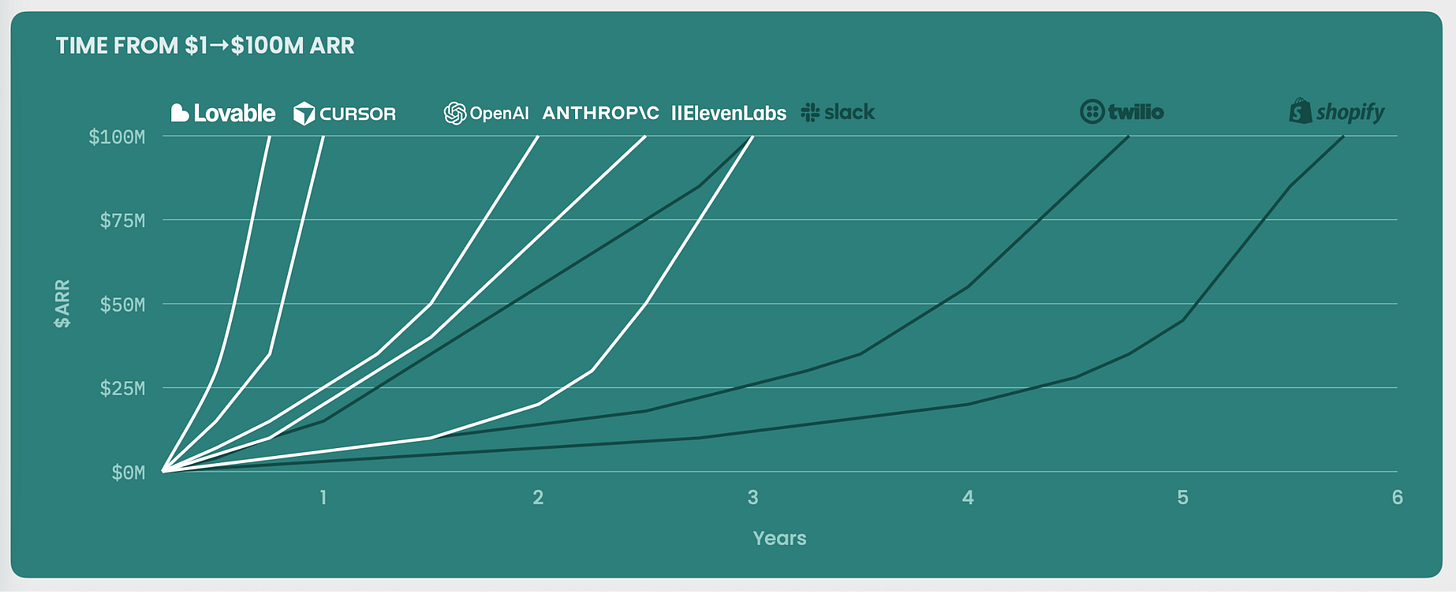

When it comes to investments, one of the major key drives recently has been the time it took leading AI companies to scale from $1 million to $100 million in ARR, showing an acceleration unmatched by previous software generations. Firms such as Lovable, Cursor, OpenAI, Anthropic and ElevenLabs reached the $100 million mark in roughly one to two years, far faster than earlier benchmarks like Slack, Twilio or Shopify, which required four to six years to achieve similar revenue levels. This compression of the growth cycle reflects unprecedented product-market adoption, lower distribution friction and rapidly expanding enterprise budgets for AI.

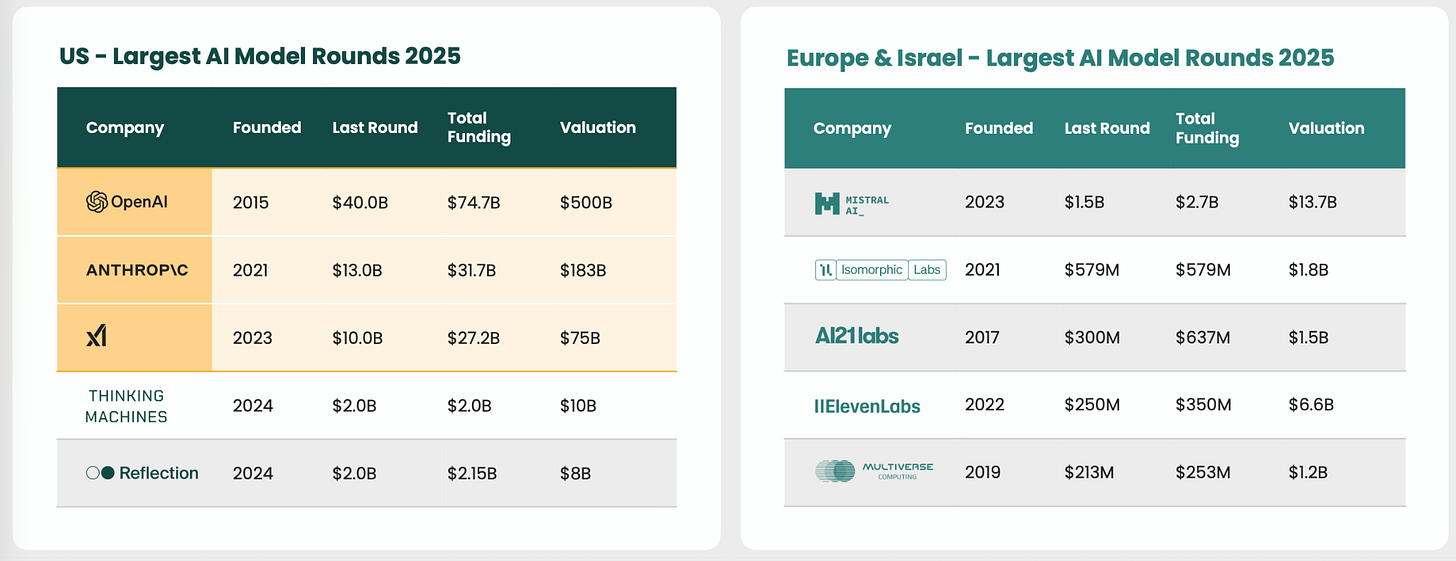

Finally, the scale and concentration of capital flowing into frontier AI labs in 2025. In the United States, OpenAI leads with a $40 billion round, total funding of $74.7 billion and a $500 billion valuation, followed by Anthropic at $13 billion and $183 billion respectively. Emerging players such as xAI raised $10 billion for a $75 billion valuation, while newer entrants like Thinking Machines and Reflection each secured $2 billion. In Europe and Israel, Mistral’s $1.5 billion round lifted its valuation to $13.7 billion, with ElevenLabs and AI21 Labs adding momentum. These figures show a market where capital pools around a few foundational-model leaders.

Anyway we saw a lot of interesting news this week. Revolut opens a Stockholm branch, PayPal gets a payment license in Mexico, Cash App releases stablecoin and ai-driven financial tools. But also, Coinbase walks away from the BVNK deal, #Lloyd banking group buying Curve for $120M, Square enables bitcoin payments and Apple expands digital ID program. Lot of movements in the VC ecosystem: BACKED VC raised a $100M fund, Vendep Capital $80M and Root Ventures $190m. But also Step fund, Oyster baby venture chaotic, sapphire venture, 359 capital. In the Italian ecosystem we saw TGP offering $1B for nexi’s digital banking units. and Lexdoit raising a 1.3M. And finally, some very interesting rounds from fintech startup like fumopay, The Beans, Freya (YC S25), FlowPay, Groww, Zilch , adclear and many more.

But let’s take a closer look at the main news of the last seven days.

Rounds

fomo raises $17M Series A led by Benchmark to expand its social trading platform

The Beans raises $5.4M seed to expand financial wellness platform for the caring workforce

Hawala raises $3M to build cross-border financial infrastructure across MENA

Freya (YC S25) raises $3.5M seed from Y Combinator and 212 VC to scale voice AI for enterprises

Falkin secures $2M to combat AI-driven financial scams before payments occur

Arx Research raises $6.1M to launch Burner Terminal for stablecoin and fiat payments

FLOWPAY secures €30M from Fasanara Capital to expand embedded SME lending in the Netherlands

Finnable raises ₹500 Crore from Z47 and TVS Capital Funds to scale digital lending platform

Wisr raises $11.4M to strengthen balance sheet and targets profitability in FY26

Groww raises $748M at $9B valuation in India’s most successful fintech IPO

Seismic secures $10M from a16z crypto and Polychain Capital to advance blockchain data privacy for fintechs

FNZ raises $650M from institutional investors to strengthen operations and growth

Adclear raises £2.1M to automate fintech marketing compliance with AI

Zaiffer.org raises €2M to launch confidential token protocol bridging privacy and compliance in DeFi

BlackRock leads $500M investment in Avalara’s AI-driven compliance platform

VC funds

Step Fund launches with €30M first closing to boost Italian seed-stage innovation

Oyster Bay Venture Capital closes €100M Fund II to back the next generation of sustainable food startups

Unconventional Ventures reaches €50M first close to back diverse European founders

Root Ventures secures $190 Million for Fund IV backing early-stage tech innovators

Section Partners closes two new funds totaling $189M to back late-stage tech

BACKED VC raises $100M Fund III to fuel Europe’s deep tech founders

Vendep Capital launches €80M fund to power AI-first SaaS startups across Nordics and Baltics

Glasswing Ventures closes $200M Fund III to back AI-native and frontier tech startups

Sapphire Sports spins out from Sapphire Ventures, as 359 Capital with $300M AUM

Viola Credit launches €300M growth lending Fund to scale European tech with non-dilutive capital

News on the market

Revolut targets Nordic expansion with new Stockholm branch to rival Klarna

BANCOMAT unveils EUR-BANK stablecoin to unify Europe’s digital payments landscape

Klarna partners with Sparkassen to launch Variable Recurring Payments in Germany

Paytm partners with Groq to accelerate real-time AI across its payments ecosystem

Coinbase launch platform for digital tokens offering, starting with Monad Foundation ICO

Venmo debuts “Stash” rewards program with up to 5% cash back on debit spending

Charles Schwab acquires Forge for $660 million to expand access to private markets

Coinbase ends $2B BVNK acquisition, rethinks stablecoin strategy

Paystand acquires Bitwage to bring enterprise-scale stablecoin payments to global finance

Revolut launches beta operations in Mexico with MXN1.8B capital commitment

ABN AMRO Bank N.V. acquires NIBC Bank from Blackstone in €960M deal

Apple Wallet expands Digital ID to 250 TSA checkpoints, redefining digital identity and KYC

Block integrates AI-driven financial tools and stablecoins into Cash App

Lloyds Banking Group reaches £120M agreement to acquire digital wallet provider Curve

PayPal gets payments license in México to expand regulated operations

Italian market

TPG makes €1B offer for Nexi Group’s digital banking solutions unit

LexDo.it raises €1.7M to simplify business creation and management for entrepreneurs

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

Seamless Saudi Arabia | Riyadh - 17-19/11/2025 (link here)

MoneyLIVE Payments | Amsterdam - 19-20/11/2025 (link here)

22nd Bank Management Conference | Athens - 20/11/2025 (link here)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #106.

The segment on agentic AI for credit data really caught my attention. What are your thoughts on potenial regulatory hurdles for such innovations? Your analysis is always so thorough and insightful.