Welcome to this edition of the weekly newsletter. The idea behind this is to gather all the information in the startup ecosystem in one place, with a special focus on the fintech market and the VC industry.

Builders is back with Season 3! This week, I sit down with Tuomas Toivonen , founder and CEO of Holvi . You can find the full episode here on YouTube, or here on Spotify and here on Apple Podcast. But take a look first at a short clip from the video:

Tuomas has over 15 years of experience advising governments and global mobile operators on payment systems. He saw the need for a better banking solution for small businesses in Europe. This drove him to create Holvi – a banking-service designed to meet the unique needs of SMEs.

Holvi is an Helsinki based digital bank, offering small businesses, from freelancers to micro businesses and growing startups, a home for their finances. With a business account and Mastercard, invoicing and bookkeeping tools all in one place, Holvi simplifies the time-consuming distractions of financial admin, helping small business owners to manage their balance.

With him, we talked about the experience of launching a neobank in the nordics, the different funding environment in fintech between 2012 and 202, but also the main challenges in financial services in the current environment.

Coming back to us, I’ve been reading a very interesting report this week, the “Venture and growth capital in Europe: mapping pension funds attitude” from European Women in VC. The report, is a very interesting study about how pension funds actually invest in VC, with a clear geographic distinction in terms of preference. Here my main takeaways:

Venture capital has traditionally been an unpopular asset class for European pension funds, but recent initiatives such as the Mansion House Accord in the UK, new legislation in Italy, and the Tibi II Initiative in France signal growing efforts to increase institutional allocations to private markets. European pension funds, covering both EU member states and the UK, allocate far less to private equity (PE) and VC compared to U.S. pension funds, where exposure is significantly higher. In the UK, available data reflects only VC allocations within defined contribution (DC) schemes; figures from local government pension schemes (LGPS) and defined benefit (DB) schemes remain unavailable, suggesting actual allocations are understated.

The analysis reviews the structure, size, and asset allocation patterns of pension markets in the EU, UK, and U.S., alongside trends influencing them. Case studies illustrate how pension schemes in different regions are approaching venture investments. Insights from interviews with pension funds further contextualize these figures, highlighting both the investment rationale for VC and the main barriers limiting larger allocations. These discussions also explored links between VC and impact investing, particularly in supporting a sustainable economy and applying social and gender-focused investment lenses.

The European Central Bank categorizes retirement provision in the EU into three pillars: Pillar I, the public statutory pay-as-you-go (PAYG) system; Pillar II, occupational pension schemes; and Pillar III, private pensions and life insurance products. With ageing populations and fiscal pressures straining Pillar I, and Pillar III remaining voluntary and uneven across member states, strengthening Pillar II has become essential to ensure sustainable and adequate retirement incomes in Europe.

Occupational pension schemes under Pillar II, established by employers on behalf of employees, are increasingly central. These schemes may be managed by Institutions for Occupational Retirement Provision (IORPs), insurance companies, or other financial entities. Collectively, insurance corporations and occupational pension funds hold around €10 trillion in assets, with the IORPs sector alone accounting for approximately €2.7 trillion of assets under management, representing about 25% of the EU pension industry.

Investment strategies among European IORPs differ by country, shaped by local economic, regulatory, and cultural contexts, but overall remain conservative with a preference for listed equity and fixed income. Around 40% of IORP assets are allocated to investment funds, making them the main channel. Within this, 33% goes to listed equity funds, 25% to debt funds, 14% to real estate, 4% to alternatives (real assets, PE, venture, growth), and 24% to other categories.

Geographically, 17% of investments remain domestic, 39% are allocated within the EEA (with the Netherlands, France, Luxembourg, and Germany together receiving 30%), 30% to the U.S., and 14% to other regions. Bonds represent 34% of total assets, with government bonds nearly double corporate bonds; 77% of central government bonds are EEA-issued and 9% U.S.-issued. Direct listed equities account for 16% of assets.

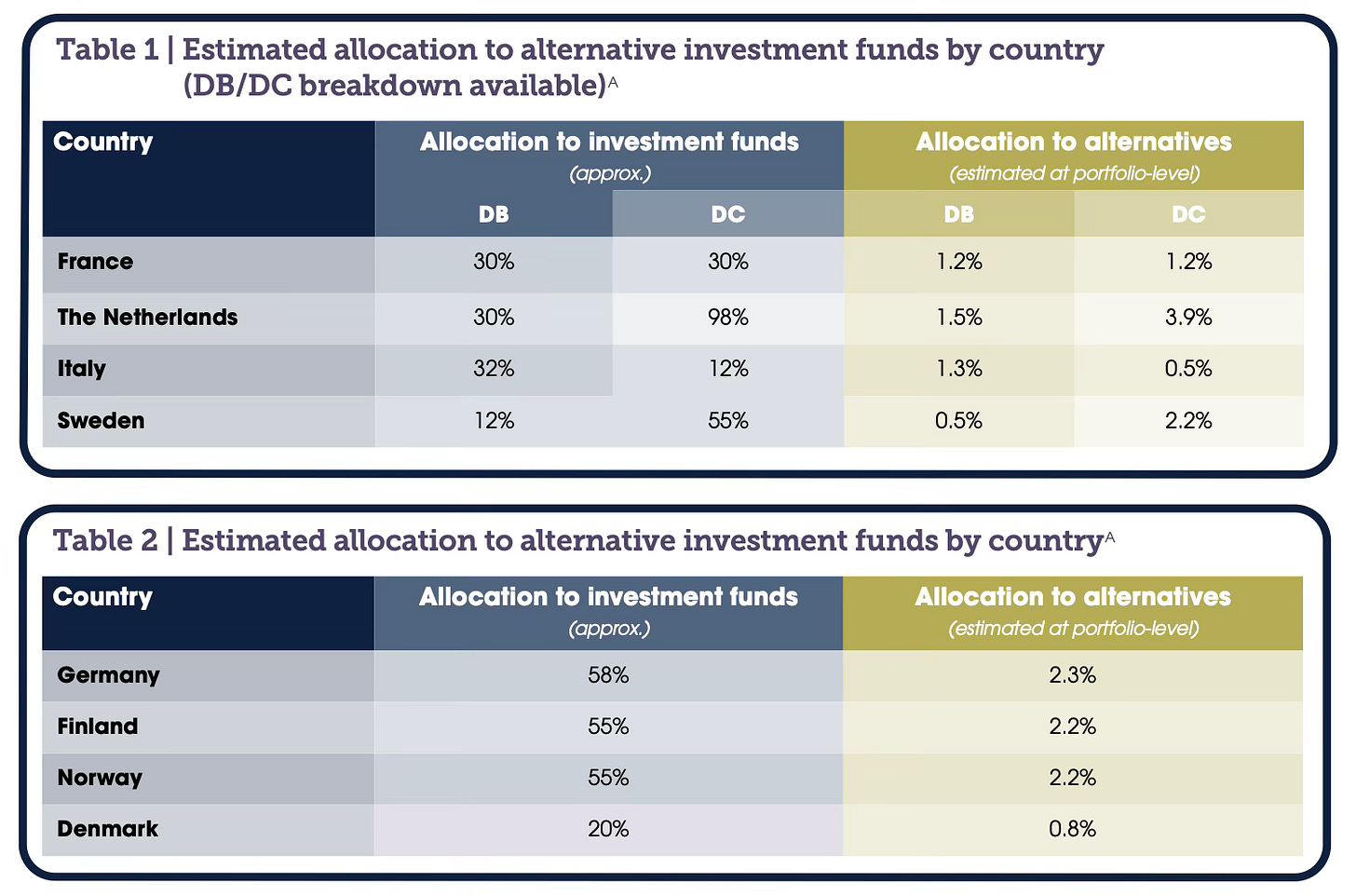

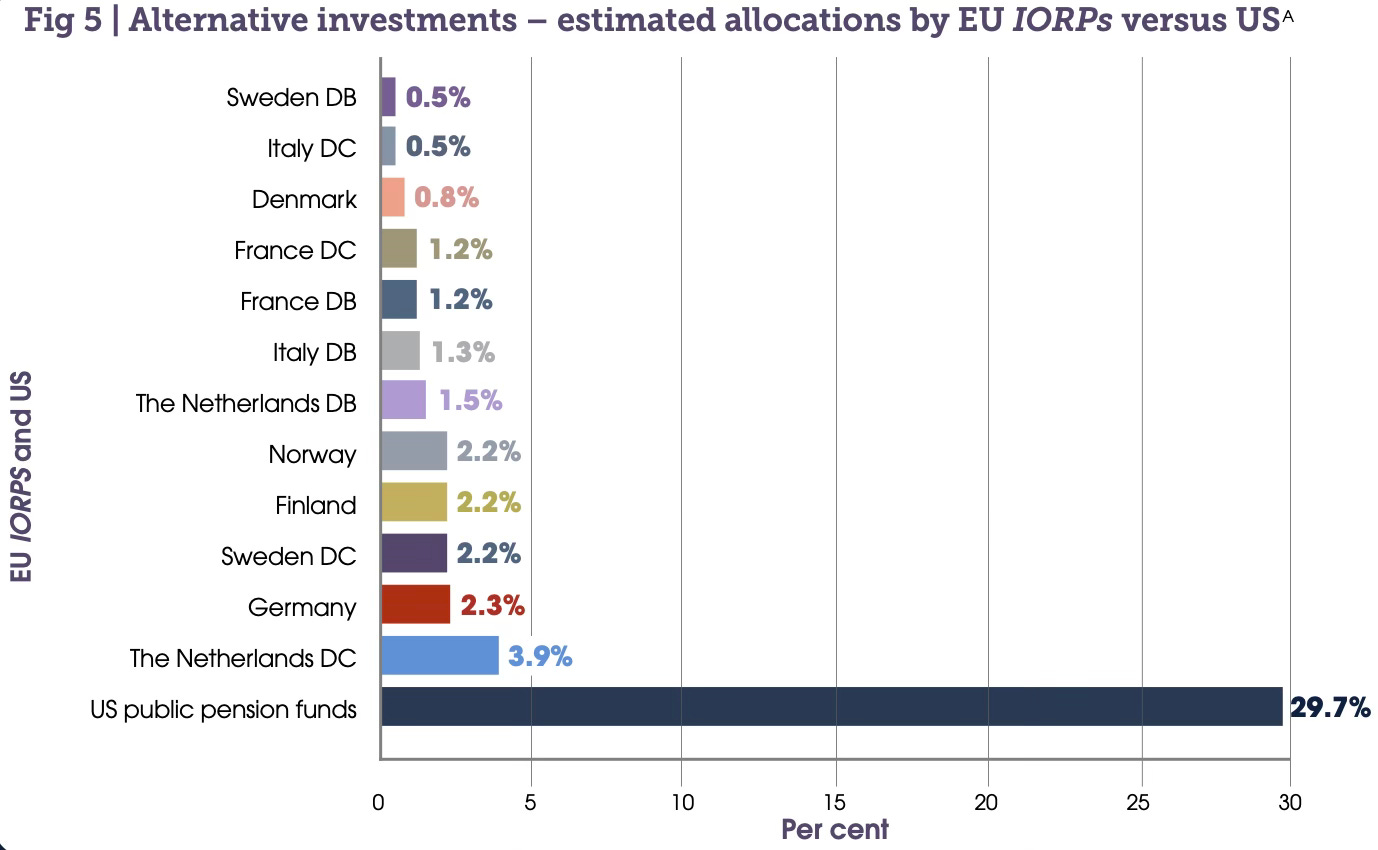

At EU level, the 4% allocation to alternatives translates into roughly 1.6% of total assets. Country estimates vary: France (1.2%), Netherlands (DB 1.5%, DC 3.9%), Italy (DB 1.3%, DC 0.5%), Sweden (DB 0.5%, DC 2.2%), Germany (2.3%), Finland (2.2%), Norway (2.2%), Denmark (0.8%). While VC-specific data is unavailable, these figures provide a rough approximation of exposure to alternatives, which may include venture capital.

Around half of European venture capital (VC) funding originates from pension funds within the region, with additional significant contributions from North American institutions. Regional disparities, however, remain pronounced. VC funds in the DACH region (Germany, Austria, Switzerland) secured approximately €115 million in allocations from pension funds in 2023, primarily sourced domestically, complemented by inflows from France, Benelux, and North America. By contrast, Southern Europe and Central and Eastern Europe remain far behind their peers, both in local pension fund commitments and in attracting foreign capital. Pension funds in these regions allocated only about €25 million to VC in 2023, with the bulk of this coming from domestic investors.

When viewed alongside broader pension fund allocations to alternative assets, the gap with the United States becomes clear. U.S. public pension funds allocate a significantly higher proportion of assets to alternatives, including venture capital, whereas European pension funds remain far more conservative. This contrast underscores both the limited scale of VC allocations within Europe and the structural differences in investment approaches across the Atlantic.

Anyway we saw a lot of interesting news this week. OpenAI closes a $6.6B secondary share sales at $500B valuation, making it the most valuable private company in the world. Revolut is considering a $75B dual listing in NY and London, Swift launched a blockchain ledger with more than 30 global banks. Nubank is looking for a banking license in the US and EA has been acquired in a $55B leveraged buyout deal, the biggest ever. A lot of new funds this week! Matt Miller announced the $400M fund for Evantic Capital, Serena with a $200M fund, Better Tomorrow Ventures with a $140M fund to invest in fintech and Notion Capital with a $130M fund, but also Lobster Capital, Expeditions, Concept Ventures and Creator Fund. In the italian ecosystem we saw Lexroom.ai raising a $16M series A and Serenis raising a $12M series A. And finally, some very interesting funding rounds from fintech startups like Zippi , Bite Investments, Tokinvest, Trig, Reveni, PAID and many others.

But let’s take a closer look at the main news of the last seven days.

Closed deals

Zippi secures R$85M to scale SME credit in Brazil

Paid raises $21.6M seed to redefine AI software monetization

FLIZpay secures $1M pre-seed to expand fee-free mobile payments in Europe

Reveni raises €7.5M to automate cross-border e-commerce logistics

Bite Investments raises $25M to accelerate private markets transformation

Finture raises $32M in C-1 round to expand digital banking YUP across Southeast Asia

umony secures $15M Series A to scale AI-powered compliance for global finance

Tokinvest raises $3.2M pre-seed to scale regulated RWA tokenisation platform

Love Finance secures £45M debt financing to expand SME lending in the UK

Trig raises $6M seed to scale AI-driven account management platform

Thought Machine secures £45M amid rising losses and flat revenues

Baselane secures $34.4M and launches AI-powered suite for real estate investors

Teylor secures €150M from Fasanara Capital to scale SME financing across Europe

Mesta raises $5.5M seed to scale hybrid fiat and stablecoin payments

Insights on the VC industry

Matt Miller announces $400M fund for Evantic Capital to back global AI-first startups\

Concept Ventures raises €75M Fund II to build Europe’s largest pre-seed vehicle

Notion Capital closes $130M growth fund to back Europe’s scaling startups

Serena launches €200M fund to drive applied AI and energy transition

Gabriel Jarrosson raises $12M Lobster Capital fund focused on YC startups

Expeditions raises over €100M for Fund II to back Europe’s security and DeepTech founders

Better Tomorrow Ventures raises $140M third fund to double down on fintech

Creator Fund secures $41M first close to back Europe’s PhD founders

Denmark launches 55 North, and €300M quantum fund to secure global leadership

News on the market

Revolut is considering $75B dual listing in London and New York

Cleo founder calls for LSE–Nasdaq merger to revive UK capital markets

TymeBank accelerates Southeast Asia push with Indonesia retail banking move and Vietnam entry

Swift to launch blockchain-based ledger with 30+ global banks

Santander brings BNPL platform Zinia to Spain through Amazon partnership

Stripe and OpenAI launch Agentic Commerce Protocol to bring checkout into ChatGPT

Electronic Arts (EA) taken private in record-breaking $55B leveraged buyout

Visa pilots stablecoin funding to transform cross-border payments

Nubank seeks U.S. National Bank charter to expand global footprint

SumUp prepares EU and UK banking licence applications to expand SME banking

Stripe advances Stablecoin strategy with U.S. Federal Charter plans

OpenAI reaches $500B valuation with $6.6B secondary share sale

Bending Spoons in talks to acquire AOL for $1.4B

Checkout.com secures Georgia banking charter to accelerate US expansion

A special look in the Italian market

Lexroom.ai raises €16M Series A to accelerate European expansion

Serenis secures €12M Series A to scale digital health services

And here some useful resources for everyone involved in the ecosystem:

Events you don’t want to miss

Infintech 2025 | Porto, Montenegro - 09-10/10/2025 (link here)

5th Annual Digital Banking Summit | London - 21-22/10/2025 (link here)

Singapore Fintech Festival | Singapore - 12-14/11/2025 (link here)

Seamless Saudi Arabia | Riyadh - 17-19/11/2025 (link here)

MoneyLIVE Payments | Amsterdam - 19-20/11/2025 (link here)

22nd Bank Management Conference | Athens - 20/11/2025 (link here)

You have a cool event you want to mention or to sponsor? Feel free to send me a DM.

Startups raising funds

Loyyal - Loyalty platform from the MENA region, with entities in the US and South East Asia, provides a B2B2C platform to handle multiple loyalty programs and earn rewards all over the world. Raising a $6M Series A

Freedhome - Proptech and fintech platform, enabling people to be able to gain profit from real estate by renting them to intermediaries. Raising a $1M seed round

Weagle - B2B Tech startup that provides the very first browser designed for company, with total security for sensitive data. Raising $6 millions for their seed round.

Shoppy Code:Gift card platform that offers a points based loyalty program. They share part of the profits coming from marketing budgets with their customers. Raising $500k.

Take also a look at the last edition of the newsletter, Weekly update #100

Thanks Michele for the mention!